There are several factors to consider when looking for the best spots to invest in real estate. Population shifts, unemployment rates, and of course the prices of homes or the monthly rent a property could realistically achieve are some of the most important stats to follow. We’ve compiled reliable data to help highlight some of the best cities in Florida to invest in real estate based on their economic growth and current real estate market.

An Overview Of The Florida Real Estate Market

First let’s look at the Florida market as a whole. Florida has one of the fastest growing job markets and populations in the country. Florida is currently the third most populated state in the country behind California and Texas. Warm weather, cheaper property, and relaxed restrictions brought hundreds of thousands of new residents into the state. The state acquired approximately 387,479 new permanent residents between April 2019 and April 2020, making it one of the biggest annual population growths that a single state has seen.

Real estate investing is already exploding in Florida, with fix and flips, new construction, and rental portfolios all growing throughout the state. In Q2 of 2020 the average gross profits from fix and flips for the state reached $65,350, making it one of the top states for fix and flips. For new construction, 97,570 permits were issued for new residential construction throughout the state during 2020, representing a 17% year over year increase and marking a 10-year high for the state. Most of the new residential construction occurred in West Florida, with 22,000 permits being issued in cities for that region. The rental market remains strong, with rent in Florida being 8.5% higher than the national average with its average monthly rent being $1,790.

Florida was one of the states that chose to not extend their foreclosure moratorium, letting it expire on October 31st, 2020 resulting in hundreds of thousands of foreclosures and distressed sales on the horizon. As of January 2021, Florida was among the top states in the country for foreclosures with one in every 7,920 homes in or entering foreclosure. This represents an 83% drop in foreclosures from the previous year- however, these current numbers are not reflective of the market reality or what the reality will be in the coming months. Many foreclosures are currently back logged and will be moving slowly through the legal system, and as federal government-led programs begin to relax the number of foreclosures will continue to increase over time.

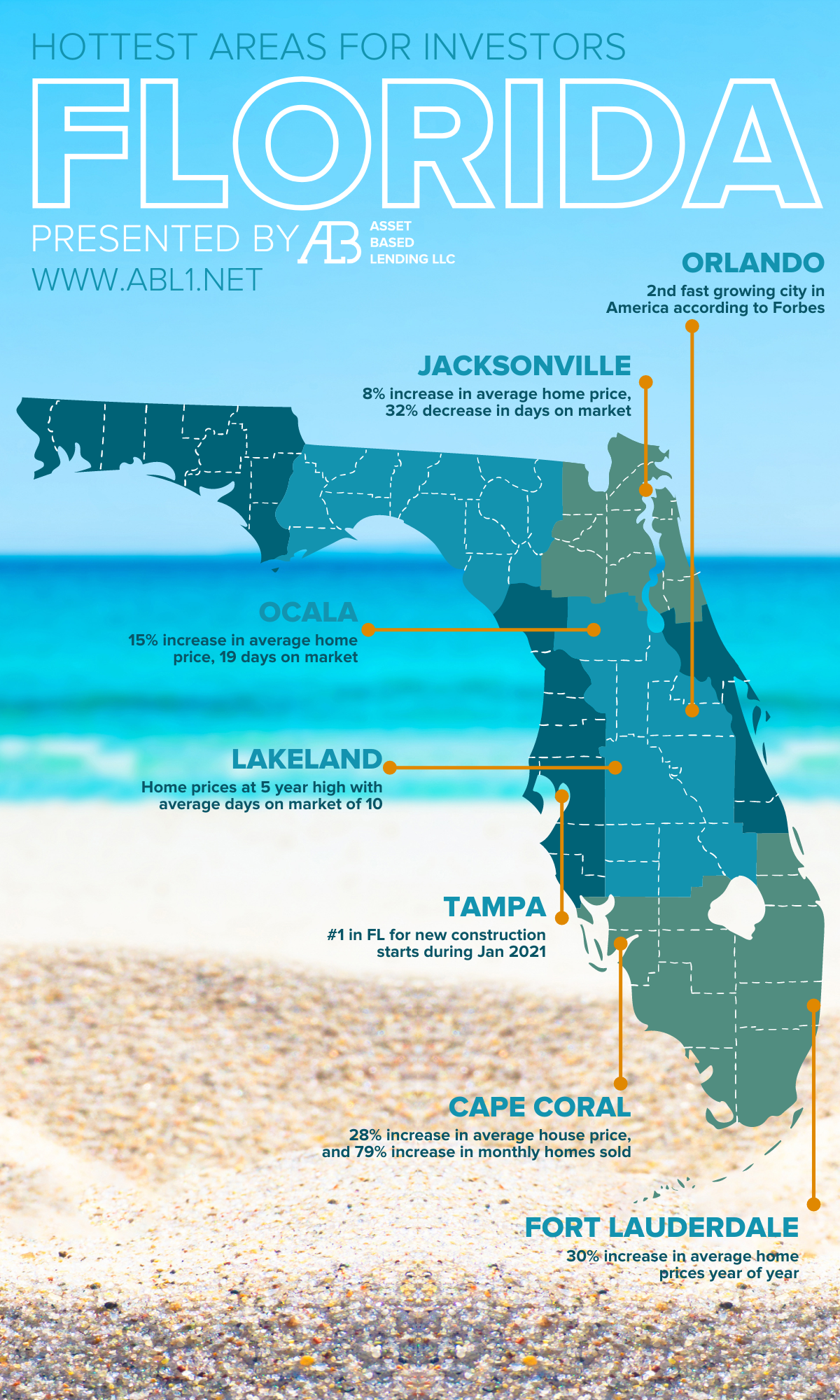

Now let’s highlight some of the most popular and best Florida cities for real estate investing and break down what makes them such good investment opportunities.

Orlando

Forbes just ranked Orlando as the #2 fastest growing city in America, and the pandemic helped push that population growth forward, making it one of the top Florida cities. With so many people seeking permanent residence in warm areas and growing tired of harsh government restrictions, states like Florida and Texas saw major upticks in their population growth. As of now, Orlando is the 3rd largest metro area in the entire state with a population of approximately 2.5 million. It is also the fourth largest city in Florida and largest inland city, making it a prime location in a state that is experiencing strong population and economic growth. Orlando also had one of the healthiest unemployment rates in the country pre-pandemic, hovering around 2.5% at the end of 2019. While the pandemic skewed this number, the city is still showing signs of healthy economic recovery that could return to this number in due time.

New construction has flourished in Orlando, ranking as 3rd in the state for new residential construction with 1,565 housing starts totaling $480 million in value. Most of these new builds are coming from Orange and Brevard counties, which have average home prices of $325,000 and $272,000 respectively. These homes are selling rapidly too, with Zillow listing Orlando in one of their top ten cities in Florida for first-time home buyers and homes spending an average of only 18 days on the market.

The city has a strong rental market, with 45% of the population renting rather than owning. The rent price nearly matches the national average with an average rent of $1,432, making it affordable and accessible for a wide variety of potential tenants. Orlando is also consistently ranked as the number one city in Florida for purchasing a profitable rental property. Being able to find tenants and secure your monthly income is the biggest gamble of owning rental property, so the consistency that Orlando brings makes it a reliable long-term investment for buy and hold investors.

Tampa

Tampa is a real estate investment hot spot for several reasons, with its population of 4 million making it one of the biggest metro areas in the country and continuing to grow larger every month. One of the major reasons for growth is that the city has become a headquarters for several Fortune 500 companies in the financial and health care industries, which constantly brings in new permanent residents while maintaining a strong economic market. Job growth and population growth go hand-in-hand for creating a real estate market with lots of demand, and these jobs are well-paying in sectors with high ceilings so the local economy booms. The cost of living is also 5% less than the national average, which helps home buyers stretch their dollar further and allows them to spend more on a home in this highly competitive market. Tampa ranked #1 for new construction in January 2021 with 2,244 house starts and total construction value in excess of $600 million The majority of this new residential construction is coming from Polk and Pasco counties. Homes in Tampa are currently selling for $190 per square foot, marking a 17% increase from the previous year. Builders and contractors that can source materials directly to reduce construction cost could put together lucrative new builds, as long as they can find available lots for sale. Between the job growth, population growth, and reduced cost of living, this market is attracting buyers and renters from all parts of the country. Much like the current Orlando market, Tampa has a very strong rental market with 44% of the population choosing to rent. Currently the average monthly rent is $1,432, which is a 5% increase from the year before and closely matches the national average, making it an affordable option for such a major metro area. The consistency of this market’s growth makes it an excellent option for real estate investors looking to expand their rental portfolio.

Lakeland

Lakeland isn’t the first city people think of when they think of Florida, but it should be a first thought for real estate investors looking at the Sunshine State. Lakeland has experienced a 3.2% population growth year over year, making it one of the fastest growing metro areas in the entire country. This city is a major transportation hub that has continued to have a strong rental market for years, but home sales over the last year have begun to make this spot an excellent location for fix and flips and new construction too. As of March 2021, the average home prices reached a 5-year high of $250,855. 432 homes sold during the month, which is a 15% increase from the year before, and homes are spending an average of only 10 days on the market which is a staggering 63% decrease from the previous year. These fast-moving sales are indicative of a red-hot seller’s market that benefits investors looking to fix and flip or build residential new construction, as long as they can find the available inventory or lots. The lower property costs represent a lower barrier to entry for investors, but lower wages than areas like Tampa and Orlando makes this more of a mid-range market for fix and flip or new construction investments. The Lakeland rental market is in a similar position in terms of being less expensive alternatives to Orlando and Tampa, but still filled with viable investment opportunities with 40% of the population choosing to rent. Right now, the average rent is $1,164 which is a 7% increase from the year before and well below the national average, making it incredibly affordable. With most rental markets stagnant or dropping off, the fact that Lakeland has grown is impressive and highlights the strength of its rental properties.

Jacksonville

Jacksonville is situated far to the northeast of the state, nearly on the border with Georgia. While it is not as much of a tourist destination or as populated as Orlando and Tampa, it still has a continuous growing population and healthy job market that makes it an excellent investment opportunity. The population currently sits at approximately 900,000, which has experienced a 14% increase over the last ten years. Much like the other major Florida cities, its home to several Fortune 500 companies which drives the population and economic growth of the area. Investing in cities that have this level of stability and growth factors helps to minimize risk and ensure that you can cash out on your investment when the time comes. The city ranked 4th for new construction in the state with 1,400 housing starts totaling $335 million of construction value. Most of these builds were planned for Duval and St. John’s counties. As of March 2021, the average home prices in the city reached $235,000, which is an 8% year over year increase and marks a 5-year high for the area. The city saw 1,735 homes sold during the month, which is a 15% increase from the year before with homes spending an average of only 28 days on the market, marking a 32% decrease from the previous year. These stats indicate a healthy seller’s market that is continuing to grow as demand remains high. Like the other markets on this list, Jacksonville’s rental market is continuing to grow despite the pandemic. Jacksonville rent increased 5% year over year as of March with an average monthly rent of $1,173, making it less than the national average and an affordable rental location compared to how much growth the city has seen. The only real statistical downside for rentals in Jacksonville is that only 37% of the population rents versus owns, so there is less of a potential tenant population compared to the other cities on this list. Still, if you’re an investor that can secure a property in a desirable neighborhood, the demand clearly exists and should not push you away from thinking of Jacksonville for rental investments.

Fort Lauderdale

Situated in the southeast corner of the state, Fort Lauderdale has been known for its strong rental market for years but has started to see improvements to its home ownership market as well. The area is known for its high quality of life, as it was ranked by publications such as the South Florida Business Journal as one of the best cities to live due to its affordability and convenient location to places like tourist locations and major sports arenas. While the city doesn’t have the same level of economic star power as some of the other cities on the list, it’s still an area that features consistent growth with an unemployment rate under the national average. Fort Lauderdale is also home to several popular colleges and is a major travel hub for the state, ultimately making it a consistent market for owners and renters. As of April 2021, the average home prices in the city reached $417,000, which is a 30% increase from the previous year. Homes in the city are spending an average of 73 days on market with 704 sales occurring during the month. With a slightly higher average days on market compared to other areas, investors need to make sure their property is standing out among the competition to secure their sale quickly and maximize their returns. Builders should be eyeing Fort Lauderdale for new construction projects, as the higher average home cost than other Florida cities combined with the consistent volume of sales shows that the demand exists in the area. The strong rental market is one of the few major metro rental areas that didn’t take a hit during the pandemic, maintaining consistent rental statistics. 50% of the population rents rather than owns, with an average monthly rent price of $1,944. While this number is much higher than the national average, there are plenty of units in a much more affordable price range, with 92% of the available units renting for over $1,000 per month. Pre-pandemic, the rental vacancy rate was well below the national average at 4.2%, highlighting the stability of rental property in Fort Lauderdale and making it a great choice for buy and hold investors. While the vacancy rate has risen since then, all signs indicate to a healthy bounce back and that Fort Lauderdale will continue to have a strong rental market for years to come.

Cape Coral

One of the hotter markets as of this writing, largely in part due to the more affordable average home prices compared to other cities on the list. Similar to the other cities on the list, Cape Coral is experiencing lower unemployment rate than the national average with 3.4%, with future projected job growth at 41% compared to the national projected growth 33%. Places with strong population and economic growth tend to indicate growing real estate markets and smart investment locations, which Cape Coral qualifies as. As of April 2021, the average home prices for the area reached $315,000, which is a 28% increase year over year. More impressive than that is the fact that homes are spending an average of only 12 days on market, highlighting how fast homes are moving from listing date to sale date. 890 homes were sold during the month of April, which is a 79% increase from the previous year. With a lower barrier-to-entry price for property purchases and fast sale times, these numbers trend well with fix and flip investors who can lock down the inventory or new construction projects for builders and contractors that can source their materials directly. The rental market for the area has remained stable throughout the years, including remaining consistent throughout the pandemic, and even seeing some gains. The city’s vacancy rate of 5% sits below the national average, a common trend among these Florida cities, and a good sign for buy and hold investors looking for easy-to-fill city investments. The average monthly rent price for the city is $1,361 which is a 3% increase from the year before. While the rental population for the city is rather low, at only 29% choosing to rent over own, the affordable average rent contributes to the consistently low vacancy rates.

Ocala

The final market is small but mighty, situated a couple hours north of Orlando near the middle of the state. With a population of only 53,000 it’s not the most popular city outside of Florida, those who live inside the state have begun to realize its untapped potential and turned it into an excellent investment opportunity. As of April 2021, the average home price for the area reached $205,000 which is a 15% increase. Homes are spending an average of only 19 days on the market, once again showing the fire sale status occurring in some of these Florida cities. While these numbers are impressive, Ocala is currently home to one of the wildest stats in real estate market history: 667 homes sold during the month of April, which is a staggering 22133.3% increase in the number of sales for the area! This market went completely untouched for years, so the sudden real estate boom is taking smaller markets like Ocala and turning them into juggernauts for those that can acquire the available inventory. All the current stats represent far and above the five-year-highs for the city, which looks to continue for the rest of this year at least, making it an excellent choice for fix and flip investors.

Financing For Fix & Flips, Construction, And Rentals In Florida

As you probably noticed, many of these top Florida cities for real estate investments share similar growth patterns. Forbes has listed several of these cities on their lists regarding fastest population growth and biggest job market growths, which are key indicators of excellent real estate opportunities. Their rising populations and improving economies feed into their real estate markets, causing investors to benefit from these hot spots if they can edge out the competition. Always make sure to research a city before parking your cash there, focusing on the economic factors that could make or break your investment. As always, Asset Based Lending is ready to finance your next real estate investment in Florida. Whether you’re looking to fix and flip in Jacksonville or want to begin your rental portfolio in Lakeland, our team can tailor a loan that matches your specific project. We continue to offer the fastest and most reliable hard money loans for real estate investments, including the only true zero-point program in the industry. If you’re looking for a hard money loan in Florida, give us a call at 201-942-9089 or email us at [email protected].

0 Comments