Multifamily

The Premier Hard Money Lender For Multifamily

Multifamily investing is a hot commodity, with housing shortages delaying first-time home buyers and increasing the demand for multifamily complexes. As top multifamily lenders, Asset Based Lending offers fast and reliable hard money loans for multifamily investors across the country. These loans are designed for the purchase and rehab or new construction of multifamily properties, covering 100% of the renovation costs with loan amounts of up to $10 Million and leverage up to 85% LTC. Whether you’re looking to build a 20-unit apartment complex or renovate a residential property, ABL is ready to finance your success.

Investing in multifamily real estate requires lots of planning and diligent execution, so your lending process should be easy. As the best multifamily lenders, our goal is to deliver a seamless loan process from start to finish, as highlighted by our hundreds of five-star reviews. You’ll never use another hard money lender after you experience the ABL Difference, which includes:

- Flexible underwriting – loan programs designed for investors, by investors

- Transparent communication – no hidden fees or surprise costs

- Full service – a one-stop shop for all your lending needs

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9090. We approve loans as fast as 24 hours. Our hard money loans for multifamily can fund the following projects:

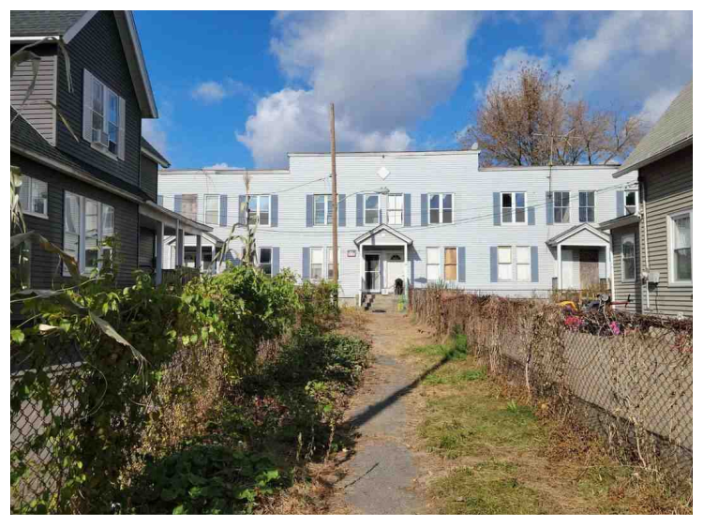

Recently Funded Commercial Multifamily Projects

Experience The ABL Difference

See why thousands of local real estate investors trust ABL to be their real estate financing partner.

MULTIFAMILY PRICE GROWTH FOR CLASS B AND C

+12%

AVG MULTIFAMILY RENT INCREASE

+17.5%

NATIONAL MULTIFAMILY VACANCY RATE

5%

MULTIFAMILY VALUE IN METRO AREAS

+24%

NATIONAL MULTIFAMILY STARTS

+18%

NATIONAL AVG CAP RATE

4.3%

Investing in Commercial Multifamily

Multifamily real estate is one of the hottest asset classes for investors, especially in major metro areas across the country. The current housing shortage has driven up demand for rental units, and the rising interest rates has people choosing to rent for longer periods rather than purchase their first home. This means multifamily property is benefiting from market conditions, which is evident by the data. Its no surprise that the cities that grew the most during the large domestic migration of 2020 are also seeing demand for affordable living spaces lead to multifamily projects.

In the top 10 metro areas in the country, commercial multifamily construction starts rose 28% year over year during Q2 2022 compared to Q2 2021. Dallas and Washington DC were among the biggest winners, with Dallas being up 72% year-to-date totaling $8.1 Billion in multifamily starts. Washington DC trails behind with a year over year gain of 35% which totals $5.5 Billion in starts. Other cities seeing huge increases in multifamily construction are the same cities that exploded in population growth in recent years such as Miami, Tampa, Austin, Houston, and Atlanta, who are all seeing multifamily starts that total more than $4 Billion of capital invested.

Best Cities to Invest in Multifamily Real Estate

Asset Based Lending are experts in the local real estate markets that we lend in, following trends and reviewing data to help our borrowers stay informed on market conditions. With commercial multifamily becoming a money-making machine for real estate investors, we wanted to share the best spots for investing in multifamily properties.

As mentioned above, the Dallas metro area is seeing one of the biggest increases in multifamily construction, with starts up 72% as of Q2 2022 totaling more than $8 Billion of construction. This metro area has also rapidly grown its population, leading the nation in consistent population growth between 2020 and 2021 with a total population increase of more than 1.5% each year for the last three years. With large Fortune 500 companies across tech, healthcare, and aerospace fields bringing high quality jobs to the city, the Dallas metro real estate market is experiencing a continuous uptick that exceeds other hot markets in the country. Homes are spending an average of less than 30 days on market, so investors need to move fast to take advantage of their opportunities.

Similar to Texas, the state of Florida benefited in a major way from the population migration of the last few years, with the Miami metro area being one of the biggest winners as the state experienced growth of 1.6% between 2020 and 2021. Multifamily starts in Miami are up 31%, totaling $4.5 Billion in construction which highlights the current demand for rental units in the city. 42% of all multifamily transactions in South Florida during Q1 2022 occurred in the Miami-Dade County area, highlighting the strength of the local real estate market and the consistent demand supporting these types of properties. Right now, real estate investors that have the knowledge and experience to renovate or build commercial multifamily in Florida should consider Miami as one of their top prospects.

The Atlanta metro area is seeing a 68% increase in multifamily construction starts, totaling $4.2 Billion for the area. As with the other city suggestions, large population growth mixed with well-paying jobs helps to make Atlanta one of the best cities to invest in multifamily real estate. Similar to the other areas listed here, Georgia as a state experienced nearly 1% population growth between 2020 and 2021, bringing in nearly 100,000 new residents with a large percentage migrating towards the Atlanta metro area. With rising rent and high occupancy rates, Atlanta multifamily continues to be a white hot investment trend, supported by the largest multifamily property sale in the city’s history occurring in Q1 2022 for nearly $127 Million.

Colorado as a whole has seen large population gains over the last decade, with the Denver metro area receiving the lion’s share of these new residents. The Denver metro area has seen a 1.34% population increase between 2020 and 2021, which accounts for approximately 40,000 people. With the demand for living spaces constantly growing, Denver multifamily starts are up 29% year over year, totaling $2.8 Billion which is on pace to expand current inventory by almost 9% by end of year. As of Q2 2022 the area boasts an multifamily occupancy rate of over 95%, and with an unemployment rate hovering around 3%, the strong local economy is going to continue supporting the need for these multifamily projects for years to come.

Tennessee has been under the radar with its growing real estate markets, Multifamily starts in the Nashville metro area are totaling $1.9 Billion and are looking to rise consistently over the next few years. The Nashville metro area is seeing population growth of 1.26% annually and is on pace for being one of the fastest growing metro areas in the entire country. Currently, the metro area boasts a 96% occupancy rate among its stabilized properties and the city’s job growth is outpacing the national average with new job growth of more than 6% each month. With more than 20,000 multifamily units in development as of Q2 2022 and demand still outpacing supply, real estate investors should consider Nashville for their next commercial multifamily project.

Multifamily Hard Money Loans For Real Estate Investors

Financing Your Multifamily Fix And Flip

Asset Based Lending specializes in fast financing for fix and flip investors, closing loans in 10 days on average with an approval process of 24 hours. By working quickly on these fix and flip loans, investors are able to remain highly competitive in their local real estate markets and take advantage of the These 12-month interest-only bridge loans utilize flexible underwriting to match your specific project, whether you’re looking for maximum leverage, lower interest rates, or something else. We work with our borrowers to design the best possible loans to meet their investment goals. Our business model revolves around the borrower, scaling with them throughout their deals to continuously improve their loan terms as they complete round trip projects with us. ABL offers funding that covers up to 85% LTC and 100% of the rehab costs. Whether you’re working on your first multifamily fix and flip or a seasoned professional looking to scale, ABL is ready to finance your flip. Click to learn more about our multifamily fix and flip loans.

Multifamily New Construction Loans

Multifamily new construction is incredibly hot right now, as demand around major metro areas outpaces the supply of available units. ABL finances loans for multifamily construction, with similar terms to our fix and flip program. We finance 100% of the construction costs and up to 85% LTC, with the ability to close the loans as quickly as 10 days. Our team services these loans fully in-house, so you’ll be under the ABL banner from your first phone call through your final payoff, guaranteeing a five-star experience from start to finish. Whether you need to close fast, are seeking flexible loan terms, or another multifamily lender simply dropped the ball, ABL multifamily construction loans can help your project come to life.

Multifamily Rental Loans

Asset Based Lending also offers rental loans for multifamily property, helping investors refinance their bridge loan directly into a long-term buy and hold loan that allows them to keep the property as an income-producing asset. Whether you’re financing a single property or an entire portfolio, ABL can help you finance your rental property investments. Our loan criteria is slightly different for our rental loans versus our bridge loans, so not every multifamily bridge loan may qualify for our rental refinance, but our team is happy to discuss your project and see how we can help.

Case Study – Multifamily New Construction

Residential Multifamily Versus Commercial Multifamily

In multifamily real estate, a property with two to four units is considered a residential multifamily property. When the property has five or more units, it is considered a commercial multifamily property. Asset Based Lending offers financing for both residential and commercial multifamily properties where at least 75% of the square footage is dedicated to residential living space.

Multifamily Asset Class Breakdowns

Commercial multifamily is classified by different grades, ranging from Class A to Class D. Class A is your high-end luxury properties that are typically beautiful apartment complexes that boast a multitude of amenities that support healthy and social living. As for real estate investors, many would think Class A multifamily is automatically the best option for making a return on their investment. However, Class A are the first to go vacant in a recession. These are luxury properties focused on extra amenities instead of simply the required living needs, so people will quickly downgrade to Class B if necessary. The type of clientele inhabiting Class A properties will also have high demands and high standards, so expenses and effort will be high when compared to lower class multifamily properties.

Class B is your middle-high class property, a comfortable and safe living situation for those that can afford to spend a little extra on their living space. These are in good locations with different options of transportation, whether its private parking spaces or close proximity to train stations and bus stations. These tend to be the best for real estate investors, as occupancy is relatively easy to maintain and tenants are reasonable with their expectations and asks of property managers.

Class C is your working class property, typically a little worn out or lived in and described as “ok” condition, with some pros and cons of living there. Sometimes the location is inconvenient for traveling to the heart of the metro area, or isn’t located near immediate grocery stores and social life. Many multifamily properties fall into this category, as this is your standard living arrangement across a large variety of income brackets. Asset Based Lending focuses on Class B and Class C multifamily properties, believing these to be the best options for real estate investors.

Class D is the lowest grade for multifamily properties, typically in undesirable locations and in need of heavy repairs. These types of properties need lots of work and attention to become profitable, along with being hard to maintain occupancy either due to poor living conditions or due to tenant’s being spotty with their ability to pay rent. Due to the high risk nature of Class D multifamily, ABL avoids lending on these types of assets.

What is a Good Cap Rate For Multifamily?

Cap rate, short for capitalization rate, gives investors an idea of what their ultimate cash flow will be after expenses. To reach this number, you divide your asset’s net operating income by the asset’s current market value. For example, if your net operating income is $400,000 on an asset currently valued at $1 Million, then 400,000 / 1,000,000 = 0.4, which is a cap rate of 4%. Understanding your multifamily cap rate will help you plan your investment for the long term and allow you to budget your capital to focus on future projects. Most multifamily properties are sustainable investment sources between 4% and 10% cap rate.

Using Hard Money For Investing In Multifamily Real Estate

Multifamily apartment investing can be tricky when it comes to financing, mainly because traditional financial institutions such as banks have an extremely strict lending process for projects of that size. Obtaining commercial multifamily loans from a hard money lender is the best option for most investors, since there’s less documentation and more flexible loan terms, allowing investors the ability to figure out their exit strategy first and receive a loan that best fits their business model.

Multifamily investors typically need to bring larger amounts of capital to the closing table simply because the purchase price of these properties tend to be higher, but ABL still finances 100% of rehab to ensure our borrowers can finish their projects without any risk of financial delays. Asset Based Lending can offer guidance as well as financing, helping to answer questions such as how to buy a multifamily property and what are the best places to invest in multifamily? As your lending partner, our commercial multifamily lenders will try to help you every step of the way, instead of just depositing money and being done with the project.

Why Choose ABL?

Local Experts Who Know Your Market

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.