Louisville Kentucky Fix And Flip Loan

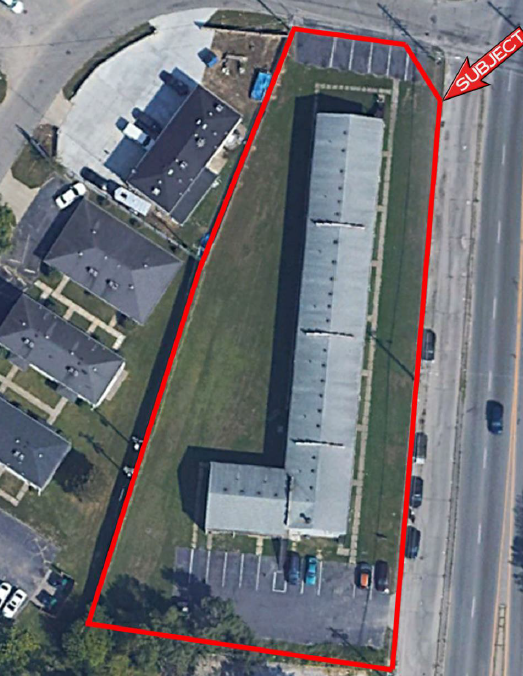

Asset Based Lending recently funded a hard money fix and flip loan to an experienced investor in Louisville Kentucky. This multifamily project consists of 34 studio apartments that are mostly gutted and will be heavily renovated. This borrower intends to complete renovations for the top floor units and put tenants in place while beginning the renovations for the units on the bottom floor. The units will be completed with rental grade finishes, new cabinets, vanities in the bathrooms, vinyl double hung windows and vinyl flooring. In Louisville, 39% of the housing market is made up of renters and 61% of the rental market consists of small complexes with fewer than 50 units, making this property a great investment opportunity. Once renovations are complete the borrowers expect to rent each unit for $700 a month which is in range for a renovated studio apartment in Louisville. The scope of work on this project is expected to be completed in 15 months, at which time the borrowers will either refinance and hold onto this complex to add to their rental portfolio, or list it for sale if market conditions permit. Though ABL’s fix and flip loans are typically 12 months, due to the extensive scope of work for this project we were happy to extend this loan out a few months to accommodate our borrower’s needs.