Reliable Hard Money Lenders In Alabama

Join thousands of real estate investors across the country that

trust ABL to be their lending partner.

One-stop-shop for real estate investor loans

Flips, builds, & rentals

100% construction/rehab financing

Close in 2 weeks or less

Single family, multifamily

Home of the Zero-Point Loan

Light documentation, no tax returns/income verification

Direct balance-sheet lender

Finance Your Investment

The Premier Alabama Hard Money Lender

Funding your real estate investment doesn’t have to be difficult- that’s why Asset Based Lending offers fast and simple hard money loans. As the best hard money lenders in Alabama, we provide real estate investors loans for fix and flips, new construction, stabilized properties, and loans for rental property. ABL uses a fully in-house team for our bridge and term programs while partnering with the best local appraisers, attorneys, and title agents in Alabama.

ABL has helped thousands of investors grow their business nationwide. Here’s what you can expect from partnering with ABL’s private lenders in Alabama:

- Quick closings – as fast as 2 days with appropriate paperwork

- Flexible underwriting – loan programs designed for investors, by investors

- Transparent communication – no hidden fees or surprise costs

- Full service – a one-stop shop for all your lending needs

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9090. We approve loans as fast as 24 hours. Our private money lenders and Alabama hard money money loans can fund the following projects:

Paul Lewis brings with him a wealth of knowledge in the world of specialty finance, especially alternative financing in the Florida and Alabama markets. In his career, he has closed in excess of $200M in commercial bridge financing, and north of $100M in specialty factoring. A native New Yorker, Paul has lived and worked in Florida for almost 10 years, where he has formed a solid network of real estate and finance professionals. Aside from finance, Paul has managed sales teams and mentored many sales people, from recent college grads, to young professionals transitioning from other industries. His approach to success is hinged on the success of his clients and their respective projects. Paul currently lives in the Palm Beach Area with his new wife, Kristen.

Mailena Garcia joined the ABL team in 2021 as a Loan Officer to help manage the firm’s growth in the Florida and Alabama markets. Her previous experience includes several years in leasing and property management where she discovered her passion for the real estate business and became an expert on industry details. She is fluent in both English and Spanish, allowing her to communicate with borrowers in their preferred language. Mailena has been a Florida native for most of her life: she was born in Cuba and moved to Florida when she was 9 years old, residing in Jacksonville to this day. When she is not at work, she enjoys traveling and reading.

Scale Up With ABL. Grow Your Alabama Investments Today.

Why Do Alabama Investors Choose ABL? The ABL Difference.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

HOME OWNERSHIP RATE

AVG FIX & FLIP PROFIT

RES. CONSTRUCTION PERMITS ISSUED

UNEMPLOYMENT RATE

Local Information For Alabama Real Estate Investors

The real estate market in Alabama has seen record growth in recent years due in part to the industries that have expanded into the state’s major metro areas. Companies like Google, NASA, and Amazon have opened facilities in Birmingham and Huntsville and have brought new residents with them. From 2021 to 2022 Alabama’s median sale price increased 12.4% from $211, 299 up to $237,477 indicating that this market is growing stronger and more competitive. The low purchase prices for the housing market in Alabama compared to the rest of the country, coupled with the increase in appreciation rates over the years, has created a draw for real estate investors, especially rental property investors. Due to these factors, the city of Huntsville was ranked tenth on a list of best places in the country to invest in rental properties. Millennial workers contributing to Alabama’s labor market are also generating strong rental income for real estate investors as this demographic are generally more interested in the flexibility of renting versus homeownership. Though homeownership still holds the majority at a rate of 69% of residents owning versus renting their homes, Alabama has seen a growing need for new luxury-style apartments across the metro areas. The need for rental properties in Alabama has created a strong rate of return for fix and flip projects with the average ROI coming in at approximately 27% statewide. Low inventory across Alabama means the market is favorable towards the sellers, and each property sees at least two or more offers. On average homes are staying on the market for sale for approximately 50 days, which is better than the historical averages for the state. With the Alabama real estate market growing more competitive it has become more important than ever to move quickly when you find the perfect property, that’s why working with a hard money lender like Asset Based Lending that closes deals in less than two weeks is the best option for growing your business.

Recommended Cities For Alabama Real Estate Investing

Asset Based Lending are experts in local Alabama real estate markets, reviewing trends and shifts to better inform our borrowers while providing the best possible loan terms for each project. Compiling data from Redfin, public town records, and local news sources, we believe some of the best Alabama neighborhoods for real estate investors are:

Huntsville recently surpassed Birmingham as Alabama’s most populous city and was named #1 best place to live in 2022-2023 by a U.S. New report. Huntsville has a reputation for being a great city for short and long term real estate investors and the Huntsville rental market is ranked 10th for being the best places to buy rental property. In 2020 the Huntsville housing market saw 13.5% of all loans purchased were for investment properties compared to only 8.5% nationally. Much of that is due to the growing career opportunities at companies like Google, Boeing, and Toyota as well as many military and tech industries that operate out of this city. The average home sale price in Huntsville is about $325,000, a 16% increase from the previous year and continuing to show rapid growth while remaining one of the most affordable housing markets in the country. Homes listed for sale in Huntsville spend 38 on the market on average, adding to the competitive nature of this growing real estate market. Rental property investors in Huntsville Alabama have benefited from a trend in repurposing retail properties into multifamily investment properties to accommodate the influx of residents to this growing city.

Montgomery is home to many governmental and military agencies including Maxwell-Gunter Air Force Base where more than 12,500 active-duty airmen work. This city is the second most populous city in Alabama and 47% of Montgomery’s housing market is made up of renters. Along with the military presence in Montgomery, there are also several colleges and universities in the area adding to the strong rental market. Montgomery rental property investors benefit from the consistent turnover of college students, above-average rent prices across the metro area, and low property taxes. With roughly half of the city’s residents renting, the low cost to purchase homes, and the rent-to-income ratio around 14.7%, Montgomery’s rental market is a strong option for real estate investors. For investors looking to flip homes in Montgomery, the median sale price has increased over the years and is now approximately $167,400 with an average of 50 days on the market. Montgomery Alabama home values have seen a 42% increase over the past five years adding to the appeal for investors. New construction projects represented 18% of the residential sales in the Montgomery housing market, but they were slower to sell with an average of 73 days on the market.

Birmingham is the third most populous city in Alabama and one of the most popular cities for real estate investors due to the low property costs, ranking #2 in the country for lowest property taxes, and the recent economic growth. Some of Birmingham’s largest employers include the U.S. Government, University of Alabama at Birmingham, Compass Bank, among others. The unemployment rate in Birmingham is below the national average at about 2.8% and wages have increased year over year, making the economy of this city strong. Birmingham’s home values have also increased by about 88% in the last five years making it a great place to invest in rental properties. The sale price for property in Birmingham in Q3 2022 was up 7.7% from the previous year to an average of $346,142, and homes are spending an average of 45 days on the market. As much as 10% of Birmingham Alabama home sales last year were new construction projects with a median sale price of $388,490. For new investors, Birmingham can be a great city to get started investing in real estate as they can find deals with prices as low as $80,000 – $100,000 and benefit from stable monthly rental income.

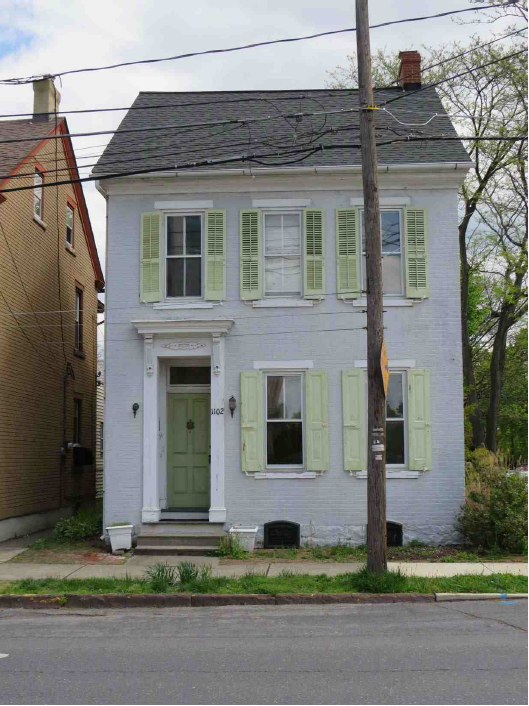

Recently Funded Fix & Flip Projects

ABL Hard Money Loans Are Financing Your Alabama Fix And Flips

At Asset Based Lending we focus on financing our fix and flip investors quickly and provide flexible underwriting that allows us to work with several different types of rehab projects. We are capable of closing on our rehab loans on average in 10 days or less to ensure that you won’t miss out on a potential deal. The 12-month interest-only bridge loans allow Alabama investors the ability to purchase property and start renovations with competitive market rates, including the industry’s only true zero-point program. ABL offers funding that covers up to 85% of purchase price and 100% of the rehab costs. Whether you’re new to fix and flips, or a seasoned profession, ABL is here to finance your flip. Click to learn more about our Alabama fix and flip loans.

Why Alabama Investors Choose Fix And Flips

Fix and flips are one of the most consistent and reliable forms of real estate investing, offering profits that allow investors the ability to funnel that capital into their next projects. Alabama offers real estate investors the benefit of low purchase prices and cost of living, providing Alabama flippers the benefit of low cost of entry. In 2022 10% of homes sold in Alabama were fix and flip projects. In the current Alabama real estate market, fix and flip investors stand to realize 26.9% in profit from their investment. Our fix and flip loans focus on closing in 10 days on average so our borrowers never miss an opportunity due to financial delays. Whether you need to close fast, are seeking flexible loan terms, or another lender simply dropped the ball, ABL is here to help.

Using Hard Money Loans For Fix And Flips

Financing a fix and flip investment requires a lending partner that can close fast and offer a variety of loan options. That’s why so many real estate investors prefer hard money loans for fix and flips, as this type of financing can close in less than two weeks and comes with flexible loan terms. For example, Asset Based Lending has closed loans as quickly as two business days with the appropriate paperwork. These speedy loans allow fix and flip investors the opportunity to secure deals that would normally be missed if using another financing option. ABL hard money loans are also less stringent with its documentation requirements- aside from recent bank statements and a credit check, ABL foregoes documents such as tax records or income verification. Investors that have tried borrowing from a bank or other traditional financial institutions know the pushback- the projects are inherently risky and banks typically don’t want to involve themselves in these types of projects. Or if they do choose to lend, it’s an agonizingly long process with enough loan stipulations, such as prepayment penalties or intensive documentation requirements, that ends up hurting the deal too much from the investor’s point of view. When it comes to fast and efficient lending for fix and flips, hard money loans are the best option for borrowers, and no lender does it better than Asset Based Lending.

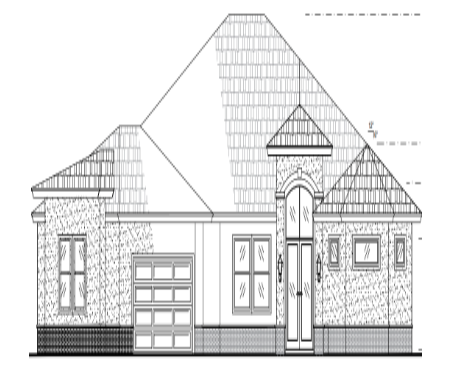

Recently Funded New Construction Projects

Loans For Alabama New Construction

ABL works with real estate investors working on new construction projects who are seeking hard money loans with competitive interest rates, fast draw turnarounds, and flexible underwriting. The 12-month new construction bridge loans are available to experienced investors, builders, and developers, who can borrow up to 70% of the land value and 100% of the construction costs. For each ground up construction project, ABL will adapt the construction loan to cater to each project’s needs, ensuring the borrower receives the best loan terms for their investment strategy. To determine the best and most profitable deal for all parties, ABL will evaluate the investor’s experience level and the viability of the project. Whether you’re looking to finance the ground up construction of single family or multifamily projects, ABL is ready to discuss your upcoming deals. Click to learn more about our new construction loans.

Alabama New Construction Investment Info

As a rapidly growing state with a limited pool of available housing inventory, Alabama’s new construction opportunities are a profitable investment in this state. In Q1 of 2023 alone the number of new construction projects started statewide was 3,289 and over the last 5 years single family home permits increased by 5.1%. With inventory levels in Alabama lingering around a 2 month supply the housing market has experienced a 2.6% price increase year over year indicating that the demand is putting pressure on the supply. The average sale price is approximately $339,400 across the state and the average number of days on market has dropped over the last 5 years from 83 to 69 days. Builders and developers are taking advantage of the growing economy, seller’s market, and low cost of developing in Alabama, and are making out with strong profits. If you are ready to use Alabama construction loans to scale your real estate business, then contact us today.

Choosing Asset Based Lending For New Construction Loans

The constant feedback from investors that utilize ABL hard money loans for new construction is that the fast time to close and loan flexibility are part of their project’s success. A slower close time or stricter loan parameters would hurt their ability to scale their real estate business as quickly as they would like. By securing financing quickly with terms that are investor-friendly, builders and developers are able to leverage ABL construction loans to their advantage and control more of the market share in the areas they invest in. While some investors seek out bank financing or private money loans, they realize the slow nature and strict guidelines of bank loans or lack of reliability from a private money lender ends up costing them deals, or causing more issues instead of making things easy. Working with a lender that’s ready to work as fast as you is invaluable, ensuring you can grow and scale your real estate business at whatever pace your strategy calls for. Asset Based Lending is run by real estate investors, so we strive to create a seamless loan process that allows investors to receive their financing quickly and focus on the project at hand. As direct hard money lenders with full control of our capital, we’re able to lend on various new construction investments and use flexible underwriting to ensure our borrowers receive their best potential loan. Whether you’re looking to build a few homes a year or you’re ready to scale to multifamily development, then contact us today to discuss your upcoming projects.

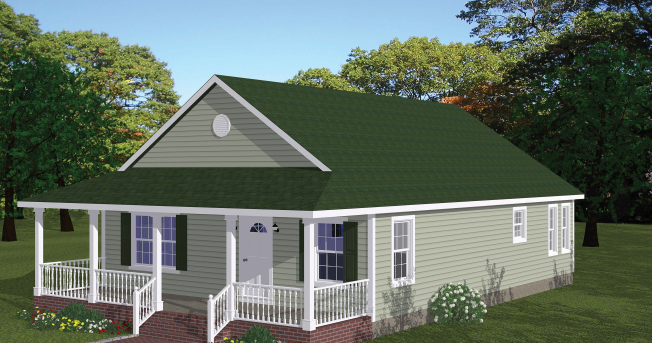

DSCR Loans for Alabama Rental Property

Asset Based Lending’s simple and reliable Alabama rental loans are designed for borrowers looking to secure properties between 1-8 units, or to refinance an entire rental portfolio. We offer competitive terms and rates starting as low as 6% with leverage up to 80% LTV with the goal of providing the most flexible rental loan options to our borrowers. This level of flexibility includes 30-year amortization, ARM, and interest only loan options. ABL offers a variety of rental loan options, with single rental loans up to $3M, and rental portfolio loans up to $3M. These loan options are available to investors of all experience levels and we will assess each deal based around the property’s income-producing viability. ABL is also able to use our bridge loan program to complete rehab on a property or finance a ground up construction before refinancing into a long-term rental loan, making us a one-stop shop for Alabama real estate investors. Click to learn more about our rental loan programs.

Alabama Rental Markets

For real estate investors looking to make a move in Alabama, the low available inventory for home buyers lends itself to a strong rental market. The percentage of renter occupied properties is up to 36% statewide adding to the power that the long term investor market across Alabama has gained through recent years. The affordable prices for homes, low property taxes, and low inventory for housing across the state, especially in the metro areas, means long term investments in Alabama have increased the profitability for investors. With cities like Birmingham where the residents are averaging 54% renters versus 46% owner-occupied, long term real estate investors can find low cost properties that generate consistent month to month income with less vacancy risk than many other places across the country. Alabama real estate investors interested in the buy and hold strategy for traditional long-term rentals, or are interested in growing a small portfolio of short-term rental properties, Asset Based Lending can help finance your success. If you’re ready to start or grow your real estate rental portfolio using our Alabama rental loans, then contact us today.

Hard Money Bridge Loans for Stabilized Property

Asset Based Lending now offers bridge loans for stabilized properties to allow more flexibility for our borrowers who need to shift with the market. As the real estate market and home sale prices cool, and rental loan interest rates are on the rise, some borrowers need to adjust their exit strategies. This bridge loan is designed for investors who have recently completed renovations, ground up construction projects, or investors looking at turnkey rental properties to eventually sell or refinance and would benefit from repositioning their investment and waiting for their desired market conditions to list their property. Regardless, ABL is here to meet your needs with an interest only loan without pre-payment penalties to bridge the gap.

How Do These Stabilized Bridge Loans Work?

Our 2-year debt service coverage loans can help bridge your financing for up to 24 months with no prepayment penalty, so you can exit the loan whenever you’re ready. With extensions available for an additional fee, we’ll make sure you’re properly financed from start to finish so that you have time to determine your final exit strategy and capitalize on your investment at the right time. We can provide stabilized financing for properties up to 20 units, using the lesser of either market rent or leased rent to determine the DSCR, and deliver you competitive loan terms. While all loans are different and structured to meet the individual investor’s needs, the typical stabilized loan is a 2-year interest-only loan with rates starting at 10.5% and LTV up to 65%-70%. Loan terms are determined based on factors such as borrower experience, FICO score, and DSCR, using the lesser of either market rent or leased rent to determine your DSCR. If you have a deal that requires temporary bridge financing, then contact us today.