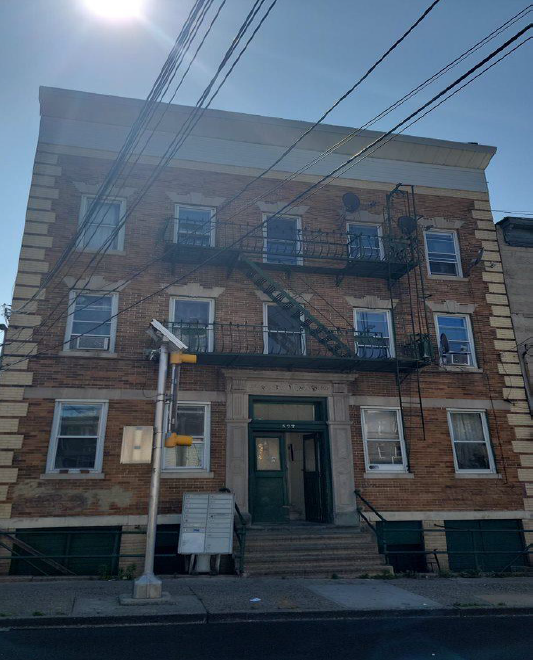

Hard money loan for Fix and Flip loan in Newark, New Jersey

Asset Based Lending is proud to celebrate our borrowers’ successful investments and give a shout-out to our amazing loan officers who made it happen. In this blog we’re recognizing Boris’ recently closed fix and flip loan in Newark, New Jersey with a fulltime real estate investor and repeat ABL borrower.

The borrower has done 5 deals in the last two years and owns 22 properties in the Newark area as of June 2023. This is the borrower’s second deal with Asset Based Lending, and they plan to do many more in the near future.

This multi-family property was purchased for $3,200,000 with a rehabilitation budget of $300,000. This deal is on the larger end of the bridge loans that Asset Based Lending specializes in. The borrower came to us through a broker who Boris met at a real estate convention in Queens, New York. Since it was easy to work with ABL, the broker recommends us to more of his clients.

Larger multi-family deals can get more complicated than standard single-family flips since there are more factors to consider. This 16-unit property totals 9,000 square feet, each unit being 2-bedroom and 1-bathroom. 6 units are currently vacant and the other 10 are leased to tenants.

The borrower has negotiated cash-for-keys with 8 tenants and the remaining 2 have agreed to allow renovation of their units. The scope of work includes a power-wash on the building, minor repairs, and installing sensored lighting.

Some bathrooms will receive updates with rental grade finishes, tiles, and vanities. Mechanical updates include minor upgrades for lights and sockets. The borrower estimates a six-month timeline for rehabilitation and plans to refinance the property once the project is completed.

Right now, it’s difficult for borrowers to get financing on commercial multi-family properties but Asset Based Lending remains persistent. In the current rental market, Millennials are either buying new construction homes or renting for longer periods of time. ABL believes in the strength of multi-family asset class combined with the buy and hold rental model and continues to lend on these investment strategies.

This deal was attractive to the borrower based on the impressive DSCR of the property and its estimated future value. When the borrower finishes the project and goes to refinance it, they expect a return of approximately 25-30% every month.

The borrower’s anticipated monthly rent is $1,850 per unit. This is in-range for the surrounding units in the area. Average rent for a 2-bedroom in Newark, NJ stands at $1,606 as of July 2023.

This positive cash-flow property is a passive income producing investment for the borrower thanks to Asset Based Lending’s DSCR rental loan.

About Newark, New Jersey

After the big boom during peak pandemic prices, we’ve seen the housing market stabilize around the country but there’s still money to be made in Newark, New Jersey. The state is putting effort in to updating neighborhoods and the city has created initiatives to move Newark’s housing forward.

The post-pandemic development strategy in Newark has been guided by equitable growth and investment prosperity. The city is seeing activity in both residential and commercial real estate as well as cultural attractions such as the Newark Museum of Art, Performing Arts Center, and Newark Public Library.

In 2023 alone, Asset Based Lending has funded 52 bridge loans and 11 DSCR rental property loans in Newark, New Jersey. Since ABL has funded hundreds of successful real estate investments in Newark over the past 13 years, we’re able provide unique expertise and insight that help guide investors through a challenging market.

According to Zillow, the 1-year value change in Newark was up 6.9% as of June 2023. In the past week, condos and townhomes in Newark sold for an average of $329,900 and spent 59 days on the market. Fair Market Rent prices are very high compared to the national average. The previous year, rent for a two-bedroom home was $1,479 per month, an 8.59% increase year-over-year.

If you are looking for homes with good flipping profit, Newark can be a successful investment option. As a top New Jersey commuter town, Newark is a profitable spot for people looking for job access to NYC. Single-family home construction increased at the end of 2022, whereas multi-family home construction decreased significantly in New Jersey as of March 2022.

While certain regions in New Jersey have seen new construction projects, progress has been sluggish this year. This is particularly notable given the persistent challenges of material shortages and rising construction costs due to inflation.

Nevertheless, Asset Based Lending has maintained a steadfast presence Newark NJ real estate investors and continues to provide lending support.

Boris’s expertise in larger bridge loans and established success in New Jersey has helped Asset Based Lending grow in our fix and flip program for borrowers in the state. Despite challenges like vacancies and renovations, Boris’s strategic approach and ABL’s steadfast support ensure the company’s commitment to the multi-family asset class.

As Newark’s housing scene stabilizes, ABL’s funding role and understanding of the market dynamics remain crucial, offering opportunities for profitable investments in a city undergoing post-pandemic growth and development.

0 Comments