Pennsylvania

Pennsylvania Hard Money Lenders

Asset Based Lending (ABL) is your local connection for direct hard money loans in Eastern Pennsylvania.We’ve been serving clients from Allentown to Philadelphia since 2017.

ABL offers real estate investors 12-month interest-only bridge financing for fix and flip projects, new construction, and cash-out refinancing, along with term rental loans for buy-and-hold investors. Whether you’re a first-time flipper or an experienced investor, ABL delivers fast closings and flexible terms tailored to your real estate investment strategy.

Prequalify Today

Prequalify for your loan today. Preliminary approval within 24 hours.

Get started on your next project:

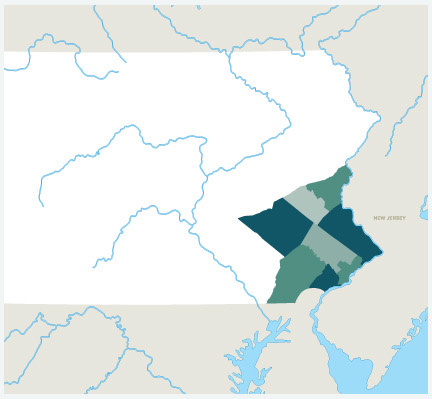

Berks, Bucks, Chester, Delaware, Lehigh, Montgomery, Northampton, Philadelphia

A graduate of Saint Joseph’s University in Philadelphia, Kyle began his career in real estate working for a national consulting firm that specialized in environmental and engineering due diligence for commercial real estate transactions. Kyle moved on to work for a local hard money lender as the outside sales manager for several years before going out on his own in 2020 as a full-time investor, agent and broker. As an investor, he has built new construction, flipped homes, rehabbed rentals to hold and completed condo conversions for vacation rentals. He has a personal portfolio of over 50 units and understands the day-to-day struggles and needs of the ABL borrowers he serves today.

Quick-Close Hard Money Loans In Pennsylvania

Fix And Flip Loans

Speed is critical to capitalizing on incredible investment opportunities, and ABL provides financing solutions that typical lending institutions cannot. We can close in three to four days if all of the paperwork is in order, and the average closing time is 10 days for our loans — which cover up to 90% of the purchase price and 100 percent of the rehab costs.

New Construction Loans

ABL provides new construction loans when conventional financing is not the right answer. New construction loans are available only to experienced investors, contractors and builders, who typically can borrow up to 90% of the land value and 100 percent of the construction costs.

Rental Loans

Asset Based Lending offers private rental loans for buy and hold investors in PA. These doc-light rental loans are designed for 1-4 family properties and start with rates as low as 6% with leverage up to to 80% LTV. Due to our unique capital structure, we can use our in-house funds to provide single rental loans up to $3M and rental portfolio loans up to $3M.

ABL has flexible loan options to best match the borrower’s needs, including 30-year amortization, ARM, or interest-only options. We will work with investors of all experience levels, whether its your first rental property or you’re simply adding to your rental portfolio.

Why Choose ABL?

Local Experts Who Know Your Market

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.