Real estate investing is equal parts strategy, vision and educated guesswork. Though even savvy and seasoned real investors can’t predict every area that’s ripe for a boom (or sell before one is headed for bust), there are some telling indicators that can help you identify whether an area is likely to yield profits for your real estate portfolio.

Low inventory, high demand. Buyers and renters are more likely to pay a premium for property — including those in need of renovation, or that lack luxuries such as dedicated parking — when they simply have no choice. If there’s a shortage of homes for sale or rent in an area you’re considering as an investment, and little in the way of affordable new housing developments, it could be a promising opportunity.

Commercial activity. Not everyone wants to live in an area with significant commercial development, but larger businesses practice due diligence and have a pulse on which areas have the economic potential to justify their presence. Conduct an online search for news coverage about the area you’re considering for your real estate investment. If your search reveals news coverage about an uptick in commercial names moving into an area, or about developments that are being considered for approval by the local development council, it may be a cue that the area is evolving.

Criminal activity. Crimes in any area are public record, and critical activity can directly impact whether buyers or renters are more likely to flock to or flee from a given area. While increased crime can be a subset of proximity to a booming city in some cases, it can also signal that an area is going downhill. The type of crime matters, too. Petty theft from a garage may not be impactful enough to drive down demand for an area, but an increase in drug or gang activity, home intrusions or violent crime could.

School system support. The amount of support the local school system has in an area can be a signal of future demand. If an area struggles to pass levies or can’t secure funding that’s necessary to support the school system, families could start to move out, and demand for the area could slow. Likewise, if an area that hasn’t traditionally had an exemplary school system builds new facilities or increases its academic performance, demand to live in the area could start to increase.

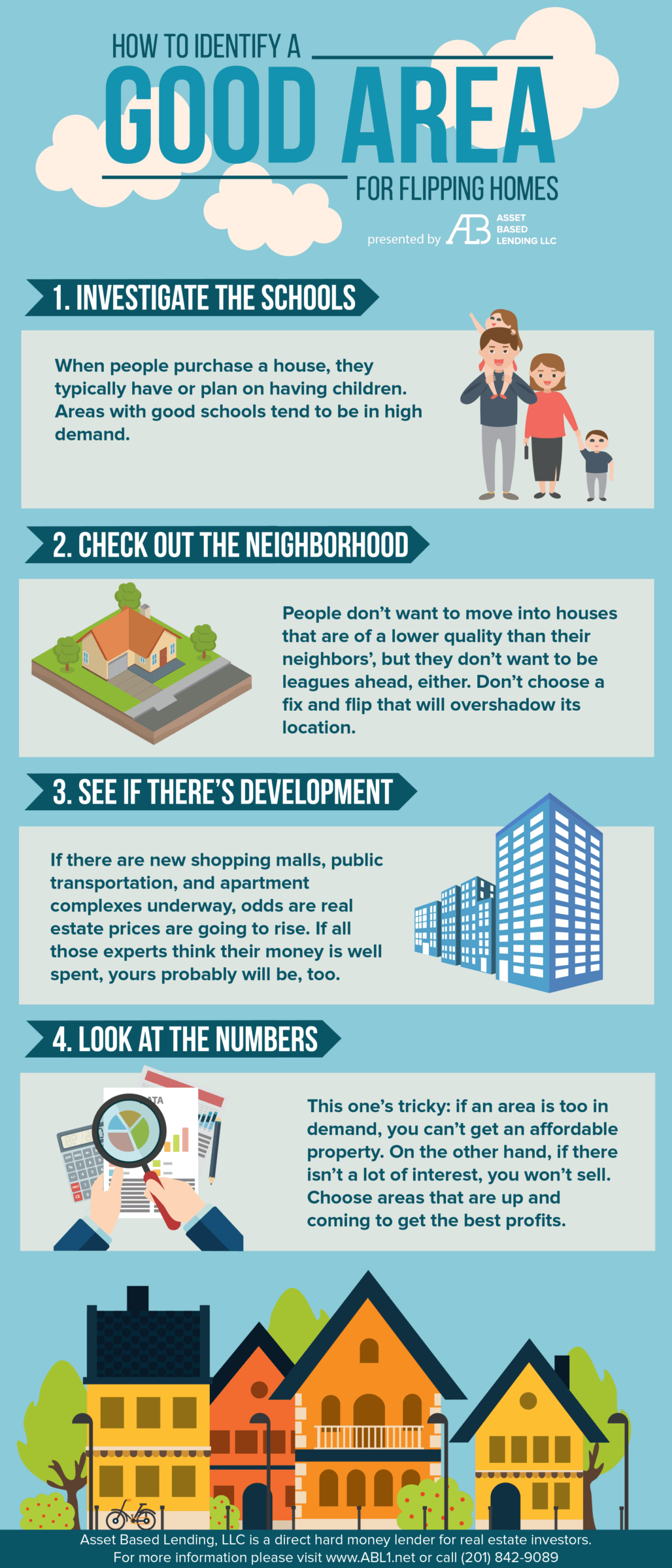

Check out this infographic with some additional information on identifying the right area for real estate investing.

Think you’ve found the hidden gem to add your real estate portfolio? Contact Asset Based Lending to explore your hard money loan options, or fill out our brief pre-qualification form online to get the process started today.

0 Comments