Connecticut Real Estate Market Overview

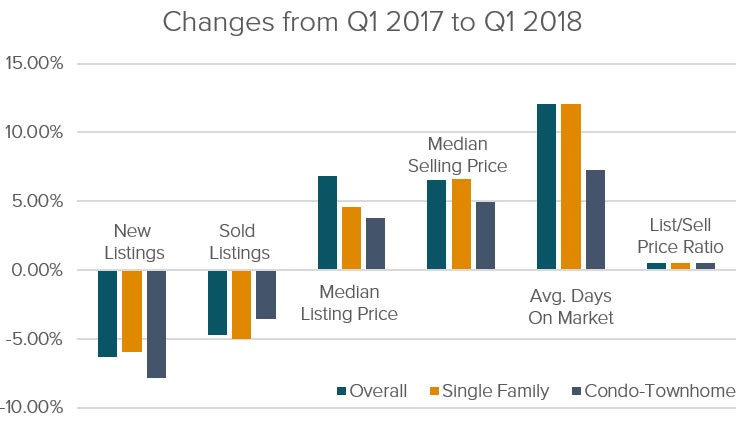

[su_row][su_column]While the total home sales in Connecticut are decreasing, the median sale price is increasing in 6 of 8 Connecticut counties as the supply of desirable homes shrinks. The houses that attracted buyers last year went for the highest prices in 4 years, with a median sale price increase of 6.5%. For single family homes, the increase was even greater, growing by 8% between March of 2017 and 2018. However, some experts warn that it is too early to confirm that the state’s increase in the average sale price is a trend. Even if prices do continue to rise, it is unlikely that the Connecticut real estate market will improve across the board. Investors need to be wary about property locations and carefully review all available data on the recent historical home sales to choose successful projects.

According to our analysis of ATTOM Data Solutions’ Year-End 2017 Home Flipping Report, the average Connecticut flipper took 210 days to complete a flip and earned a gross profit of $94,227 with a return on investment (ROI) of 78.6%.

[/su_column][su_column]Best CT towns to buy a home, according to Niche.

| City | Overall Grade | Public Schools | Housing |

| Avon | A+ | A+ | A- |

| Weatogue | A+ | A+ | A- |

| West Simsbury | A+ | A+ | A- |

| Andover | A- | A+ | A- |

| Salem | A- | A+ | B- |

[/su_column][/su_row]Historically, Connecticut has not been an ideal location for real estate investments. Over the past year, 1,400 jobs disappeared, even as the quantity of non agricultural jobs grew by 8,500. Additionally, the state’s population growth from the past year is unusually low at 0.01%. Not only is the job market struggling, but Connecticut also has the sixth highest property tax rates in the country at 2%, lower than New Jersey at 2.31% but higher than New York at 1.88%.

This year, the nationwide market trend predictions include a reduced supply of starter homes, a decreased growth in home prices, an increase in mortgage interest rates, an influx of millennials looking to buy their first homes, and suburban expansions due to the increase in taxes caused by the tax plan. With these national predictions and the tentative Connecticut trends of increasing home prices and decreasing supply, this year could be a prime time to fix up suburban homes for millennials looking to settle in close proximity to cities like New York, Hartford, and New Haven.

For investors, the best thing about Connecticut is the large supply of highly discounted houses. Investors can purchase low, invest some money in cosmetic repairs, and then find themselves with a coveted property for local renters or first time homebuyers. To take advantage of these market conditions, many ABL investors are making adjustments to their investment strategies by flipping houses in CT. Stay tuned throughout this report for the latest Connecticut real estate statistics from Attom Data Solutions, Zillow, and RealtyTrac in addition to advice from ABL’s experts on how to leverage this knowledge for your Connecticut real estate investments.

Connecticut Real Estate: Snapshot

[su_divider top=”no” divider_color=”#e4e4e4″ size=”1″ margin=”5″]

[su_note note_color=”#f6f6f6″ text_color=”#535353″ radius=”0″]

ABL Connecticut Market Insights

The Connecticut housing market took a big hit in the crash and still has not fully recovered, meaning that there are still a lot of highly discounted homes near urban areas like Bridgeport and Hartford. Astute investors can pick up a three-family property for around $100,000, spend $70,000 on rehab, and rent out each unit for $1,200/month. On a $200,000 investment, buy and hold investors can make around $25,000 in profit a year in urban areas.

Although fix and flips can be made challenging by Connecticut’s high income and property taxes, these costs are partially offset by the high quality of Connecticut schools. Connecticut schools occupy 9% of the top 100 public schools in America – not bad for a state containing less than 1.5% of the total U.S. population.

At ABL, we see a lot of success for new construction under $1 million in good school districts. In towns like Fairfield, even new construction projects over $1 million are selling before they’re done. However, builders need to adjust property expectations to the local markets. While a house in Fairfield will easily sell high, houses in Shelton, another great Connecticut town, aren’t typically going to sell for over $500,000.[/su_note]

Connecticut Real Estate Statistics:

[su_row][su_column][su_table]

| Metric | Zillow | RealtyTrac | 2018 Q1 Snapshot |

| Median List Price | $325,000 | $249,900 | $234,899 |

| Median Sale Price | $251.30 | $222,500 | $229,000 |

| ZHVI (estimated home value) | $234,800 | – | |

| Growth Forecast | 3.50% | – | |

| Avg. Days on Market | 127 | – | 102 |

| Delinquent on Mortgage | 2.20% | – | |

| Foreclosure Rate | 0.08% (0.03% higher than national average) |

[/su_table][/su_column][su_column]

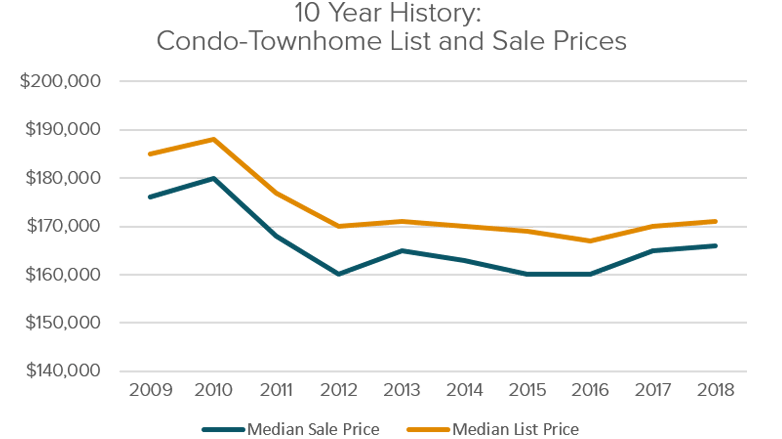

Click graph to enlarge. Q1 data and 10 year histories from Berkshire Hathaway Quarterly Market Report.

[su_note note_color=”#f6f6f6″ text_color=”#535353″ radius=”0″]

ABL Market Insights

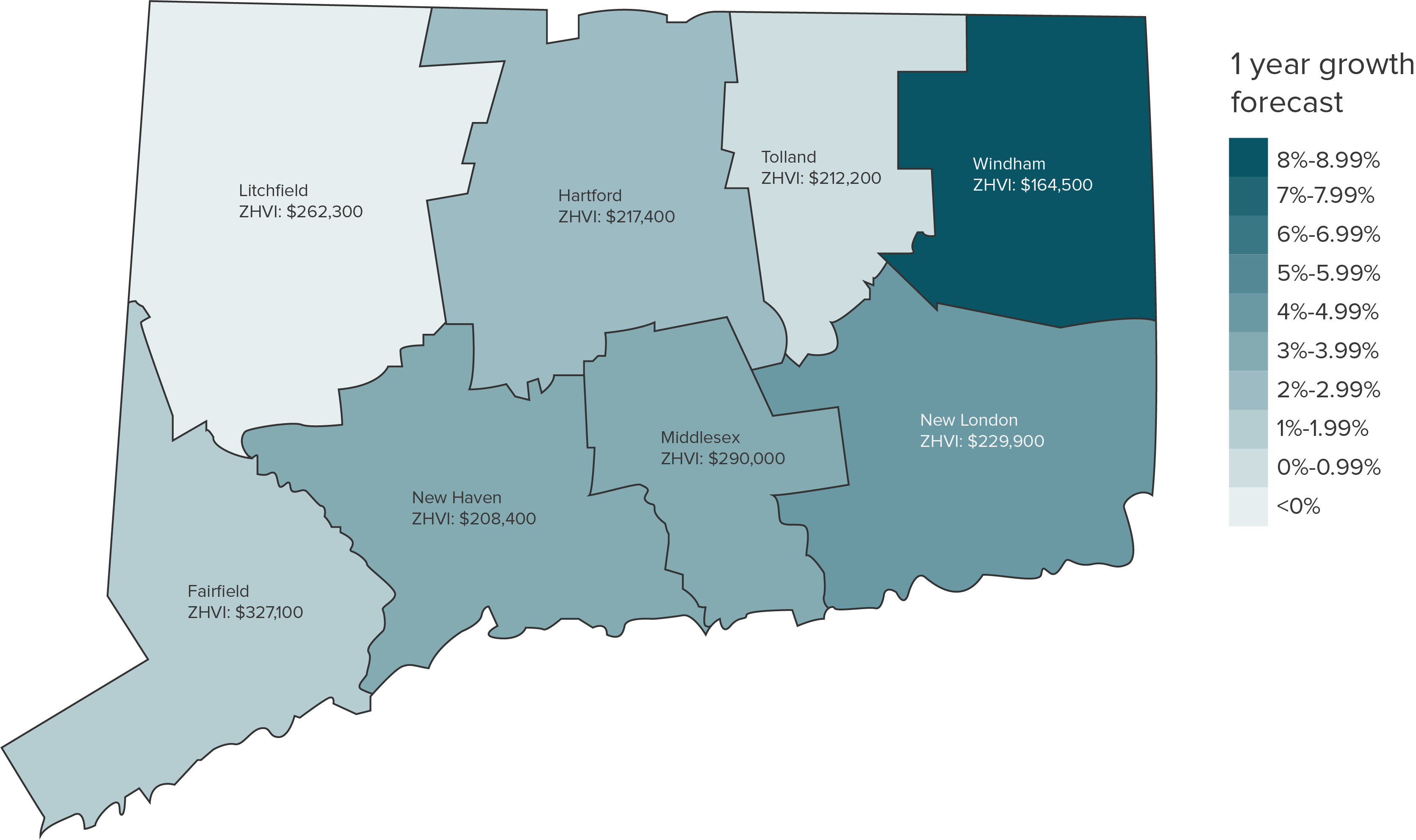

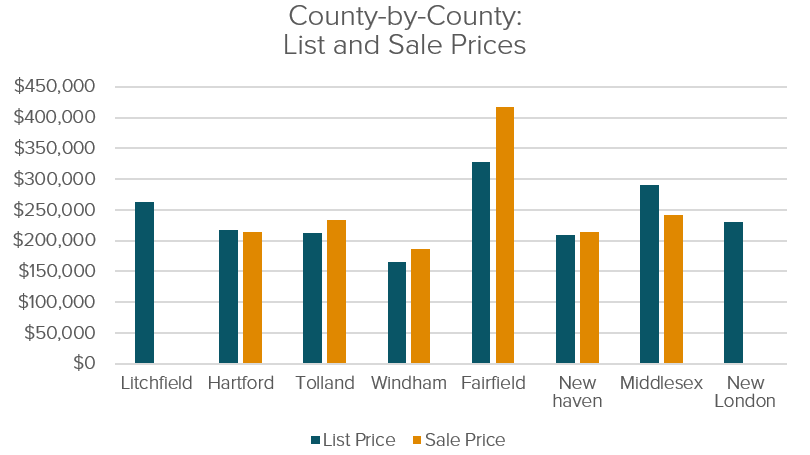

ABL does not typically lend in Litchfield or Tolland counties because they are mostly rural and there is not a lot of demand for housing, as evidenced by the forecasted housing market value growth of -0.8 and 0.8, respectively.

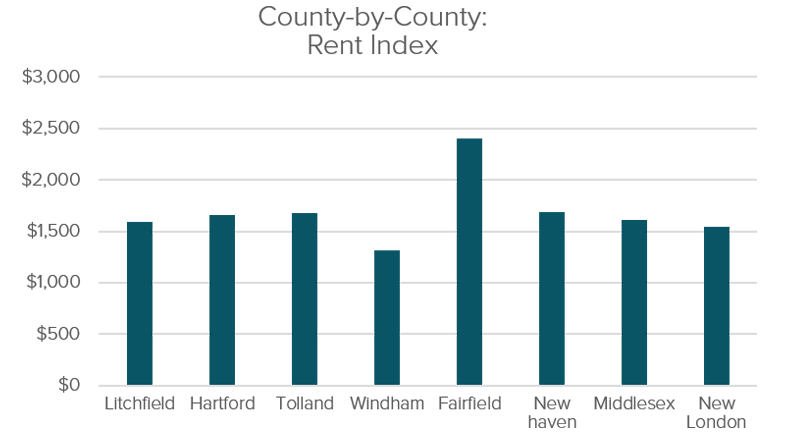

Fairfield County is struggling lately because it has historically been popular with commuters to the city; since millennials have been slow to move out of urban areas and into the suburbs, growth is slow at 1.2%. However, Fairfield County still has the highest sale and rental prices of all the Connecticut counties, as well as some of the best schools in the state.

[/su_note]

Most Profitable Fix and Flip Cities In Connecticut

According to the Year-End 2017 U.S. Home Flipping Report, the following ten cities contain the zip codes with the greatest ROI on fix and flip investments of all Connecticut locations in 2017.

1: Waterbury (ROI: 143.1%, Zip code 06708)

Nicknamed “The Brass City” because of a thriving brass manufacturing industry in the 1800s and early 1900s, Waterbury’s motto is “Quid Acere Perennius?” which translates to “What is more lasting than brass?” The city is the second largest in New Haven County, behind only New Haven itself. Today, Waterbury is more known for the Brass Works Brewing Company than its actual brassworks.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $107,900 | Crime Rating: C+ | Avg. gross profit: $93,000 |

| Hot (Sellers’) market | School Rating: C+ | Median purchase: $65,000 |

| 1-yr. growth forecast: 5.8% | Median Household Income: $40,254 | Median sale: $158,000 |

| Median listing: $120,000 | Unemployment: 8.3% | Home flipping rate: 3.2% |

| Median sale: $110,000 | Percent of Vacant Homes: 10.82% | Avg. Days to Flip: 205 |

| Rent Index: $1,267 | Homes for Sale: 245 |

2: Stratford (ROI: 122.0%, Zip Code 06615)

Located on the “Gold Coast,” Stratford lays claim to five islands in the Housatonic River and has three popular beaches. The city is great for commuters of all kinds, containing a train station, an airport, and six major highways. Additionally, Stratford is known for its Stratford Festival Theatre and National Helicopter Museum.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: — | Crime Rating: A- | Avg. gross profit: $116,500 |

| Warm (Sellers’) market | School Rating: C+ | Median purchase: $95,500 |

| 1-yr. growth forecast: — | Median Household Income: $67,530 | Median sale: $212,000 |

| Median listing: $269,500 | Unemployment: 5.7% | Home flipping rate: 7.8% |

| Median sale: $243,600 | Percent of Vacant Homes: 5.19% | Avg. Days to Flip: 226 |

| Rent Index: $1,993 | Homes for Sale: 202 |

3: Naugatuck (ROI: 116.6%, Zip code 06770)

Just south of Waterbury, Naugatuck is known for its architectural commissions by the famous architectural firm of McKim, Mead, and White. Home to Charles Goodyear and his early rubber experiments, Naugatuck still draws industrious investors today, as the impressive 116.6% ROI on 2017 fix and flip investments demonstrates. Naugatuck is likely to draw nature-loving buyers who desire proximity to the Whittemore Glen State Park and Hop Brook lake.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: — | Crime Rating: A- | Avg. gross profit: $87,703 |

| Warm (Sellers’) market | School Rating: C | Median purchase: $75,247 |

| 1-yr. growth forecast: — | Median Household Income: $59,393 | Median sale: $162,950 |

| Median listing: $194,500 | Unemployment: 6.1% | Home flipping rate: 3.4% |

| Median sale: $155,300 | Percent of Vacant Homes: 7.58% | Avg. Days to Flip: 212 |

| Rent Index: $1,536 | Homes for Sale: 90 |

4: Bloomfield (ROI: 110.5%, Zip code 06770)

Home to three beautiful golf courses (Wintonbury Hills, Tumblebrook, and Gillette Ridge), it’s no wonder Bloomfield has the second highest median household income on this list. While the south of Bloomfield is densely populated, the north has plenty of old farmland just waiting to be developed.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: — | Crime Rating: B+ | Avg. gross profit: $78,750 |

| Neutral market | School Rating: C | Median purchase: $71,250 |

| 1-yr. growth forecast: — | Median Household Income: $72,065 | Median sale: $150,000 |

| Median listing: $200,000 | Unemployment: 5.1% | Home flipping rate: 3.2% |

| Median sale: — | Percent of Vacant Homes: 5.07% | Avg. Days to Flip: 256 |

| Rent Index: $1,650 | Homes for Sale: 60 |

5: Meriden (ROI: 107.2%, Zip code 06450)

With the Meriden Farmers Market, the Hunter Golf Club, and 25 parks all within its borders, this city has plenty to attract families looking to settle down. Hubbard Park is an 1,800 acre Meriden landmark which contains the stone Castle Craig Tower which sits atop the East Peak. From the tower, visitors can see the Sleeping Giant Mountain Range, New Haven, and Long Island. Potential homeowners will be glad to know that they are so close to such a beautiful view.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $157,900 | Crime Rating:C+ | Avg. gross profit: $89,750 |

| Warm (Sellers’) market | School Rating: C+ | Median purchase: $83,750 |

| 1-yr. growth forecast: 4.2% | Median Household Income: $40,254 | Median sale: $173,500 |

| Median listing: $159,900 | Unemployment: 8.3% | Home flipping rate: 2.4% |

| Median sale: $132,700 | Percent of Vacant Homes: 01.82% | Avg. Days to Flip: 215 |

| Rent Index: $1,454 | Homes for Sale: 143 |

6: Norwich (ROI: 106.9%, Zip code 06360)

Also known as “The Rose of New England,” Norwich won the title of “Prettiest Painted Places” in New England. Some of the city’s modern attractions include the Mohegan Sun, a casino resort with spa and golf course, Gardner Lake, and the Slater Memorial Museum. Three rivers flow into Norwich: the Yantic, the Thames, and the Shetucket, making this city a perfect location for flipping houses in CT and for water lovers.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $152,300 | Crime Rating: B+ | Avg. gross profit: $77,000 |

| Very cold (Buyers’) market | School Rating: C- | Median purchase: $72,000 |

| 1-yr. growth forecast: 8.4% | Median Household Income: $52,186 | Median sale: $149,000 |

| Median listing: $154,900 | Unemployment: 5.5% | Home flipping rate: 3.1% |

| Median sale: — | Percent of Vacant Homes: 12.58% | Avg. Days to Flip: 212 |

| Rent Index: $1,327 | Homes for Sale: 137 |

7: West Haven (ROI: 95.6%, Zip code 06516)

While the settlement now called West Haven is one of Connecticut’s oldest, the city itself is the latest to be incorporated (in 1961), earning the moniker “Connecticut’s Youngest City.” Before that, it was known as West Farms, which was settled in 1648. Located on the Long Island Sound, West Haven residents have miles of boardwalk in their hometown.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $171,400 | Crime Rating: B | Avg. gross profit: $86,000 |

| Neutral market | School Rating: C | Median purchase: $90,000 |

| Very hot (Sellers’) market | Median Household Income: $51,854 | Median sale: $176,000 |

| Median listing: $199,000 | Unemployment: 5.7% | Home flipping rate: 3.6% |

| Median sale: $168,200 | Percent of Vacant Homes: 8.03% | Avg. Days to Flip: 225 |

| Rent Index: $1,664 | Homes for Sale: 128 |

8: Enfield (ROI: 91.4%, Zip code 06082)

Enfield is known for both work and play; the second largest employer in the town is Lego, a the famous toy company which has its U.S. headquarters here. Within ten miles of the profitable fix and flip town are the Six Flags of New England, Forest Park, and the New England Air Museum. For house flippers in Enfield Connecticut, the location should be an easy sell.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: — | Crime Rating: A- | Avg. gross profit: $94,900 |

| Very hot (Sellers’) market | School Rating: C+ | Median purchase: $105,000 |

| 1-yr. growth forecast: — | Median Household Income: $33,905 | Median sale: $199,900 |

| Median listing: $191,900 | Unemployment: 5.0% | Home flipping rate: 3.7% |

| Median sale: $187,100 | Percent of Vacant Homes: 4.49% | Avg. Days to Flip: 190 |

| Rent Index: $1,542 | Homes for Sale: 124 |

9: Southbury (ROI: 89.7%, Zip code 06488)

The Southbury library provides residents with free admission passes to more than ten nearby museums and parks and offers reduced admission to ten more; the town also maintains three public historic buildings: the 1762 Bullet High School, 1873 Old Town Hall Museum, and the 1904 South Britain Library. With its rich history, great schools, and public pool, this town is ideal for young families looking to settle in a quaint Connecticut town.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: — | Crime Rating: A+ | Avg. gross profit: $87,703 |

| Cold (buyers’) market | School Rating: A- | Median purchase: $75,247 |

| 1-yr. growth forecast: — | Median Household Income: $72,177 | Median sale: $162,950 |

| Median listing: $285,000 | Unemployment: 4.7% | Home flipping rate: 3.4% |

| Median sale: $197,200 | Percent of Vacant Homes: 6.92% | Avg. Days to Flip: 212 |

| Rent Index: $1,618 | Homes for Sale: 71 |

10: Bridgeport (ROI: 86.7%, Zip code 06606)

The largest city in Connecticut, Bridgeport has a history of industry and innovation. Considered the birthplace of the Frisbee because of the re-purposing of pie pans from the Frisbie Pie Company which led to the toy’s invention, Bridgeport was also home to the first Subway restaurant and P.T. Barnum, the famous founder of what eventually became the Ringling Brothers Circus. Less than two hours by train from New York City, the final spot on our list is great for millenials looking for a cheaper alternative to NYC that still has a bustling culture and economy.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $164,800 | Crime Rating: C+ | Avg. gross profit: $87,703 |

| Very hot (Sellers’) market | School Rating: D | Median purchase: $75,247 |

| 1-yr. growth forecast: 4.6% | Median Household Income: $41,047 | Median sale: $162,950 |

| Median listing: $179,900 | Unemployment: 7.6% | Home flipping rate: 3.4% |

| Median sale: $143,300 | Percent of Vacant Homes: 12.75% | Avg. Days to Flip: 212 |

| Rent Index: $1,892 | Homes for Sale: 250 |

[su_note note_color=”#f6f6f6″ text_color=”#535353″ radius=”0″]

Get a Hard Money Loan in Connecticut

If you’re looking to invest in Connecticut real estate, trust the leading hard money lender with the expertise, funds, and commitment to help you succeed. Fill out our prequalification form to discuss your deal and learn what ABL can do for you.[/su_note]

[su_spoiler title=”Sources” icon=”plus-circle”]

- https://www.courant.com/real-estate/property-line/hc-connecticut-home-sales-march-20180430-story.html

- https://www.attomdata.com/news/home-flipping/2017-u-s-home-flipping-report/

- https://www.moneytips.com/2018-housing-market-predictions/381

- https://www.niche.com/places-to-live/search/best-places-to-buy-a-house/s/connecticut/

- https://www.realtytrac.com/statsandtrends/ct

- https://www.zillow.com/ct/home-values/

- https://www.realtytrac.com/statsandtrends/ct

- https://www.bhhsneproperties.com/mce/prj/bne/Graphs/qr/preview/CT_ALL.htm

- https://www.realtytrac.com/statsandtrends

[/su_spoiler]

0 Comments