New Construction Featured Deal in Snellville, Georgia

Sam Oster, Asset Based Lending’s Assistant Vice President of Lending specializing in the Southeast, recently closed a cash out and new construction loan in Snellville Georgia. For this deal Sam is working with experienced real estate developers to fund a new construction project in Snellville, developing a community of single-family homes. These borrowers are utilizing a blanket loan to complete ground-up construction on 5 homes at once, but their goal is to complete a total of 18 single-family homes in this area over time.

Sam began his journey at ABL working on the draws and operations team, later moving into a Loan Officer role. He is extremely knowledgeable about his territory, especially Atlanta and the surrounding communities. Sam loves working with experienced investors on new construction and fix and flip projects in Georgia and the rest of the Southeastern states.

These borrowers previously worked with ABL on four ground-up construction projects and have extensive experience developing properties around Atlanta’s greater metro area. Their high level of experience completing projects like this one, along with high liquidity and fulfilling the requirements with the city to zone the land appropriately for this project, helped Sam make a case to the underwriting and executive teams to approve this deal.

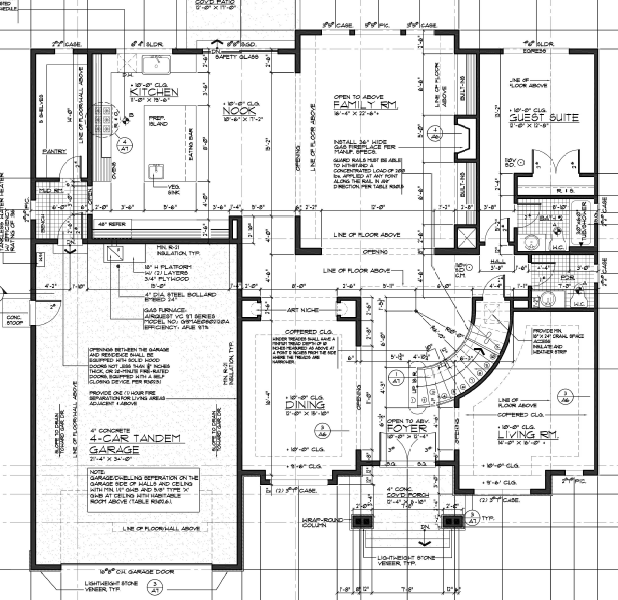

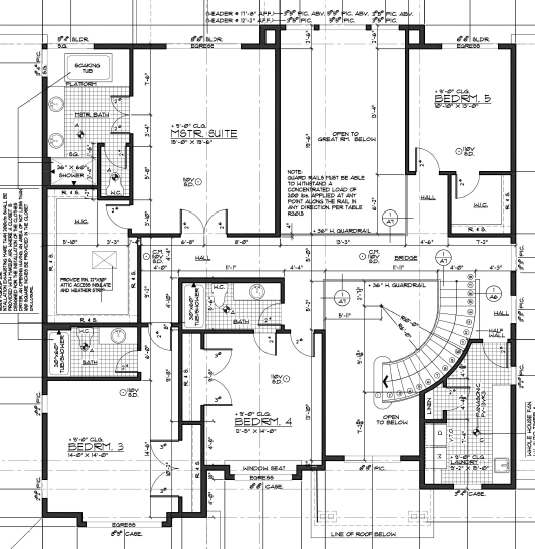

For this new construction deal in Snellville Georgia, the borrowers purchased a parcel of land and held onto it while they worked to get their ducks in a row. The borrowers came to ABL having already secured the appropriate approvals, permits, and zoning from the city to subdivide the land and build single family homes.

However, the borrowers did not have a survey for the property as 5 parcels, but rather a survey for the entirety of the property. Without a survey of the subdivided land, ABL could not extend a loan for the future 5 parcels. Treating this as a blanket loan, covering all 5 single family new builds, allowed for partial releases when the developer sold each property after construction.

For ABL’s team, this took some creative thinking as many lenders don’t allow partial releases. Sam and the underwriting team saw the potential of this deal and worked with our legal team to develop terms to allow for partial releases, allowing this deal to move forward.

The borrowers held the land while they made improvements to it, effectively increasing the value. With the improvements and the amount of time the land was owned, the borrowers earned equity on it. Together, the equity and years of ownership allowed ABL to extend a cash out on the property as well as fund the new construction. With the cash received at closing, the borrowers started their project right away.

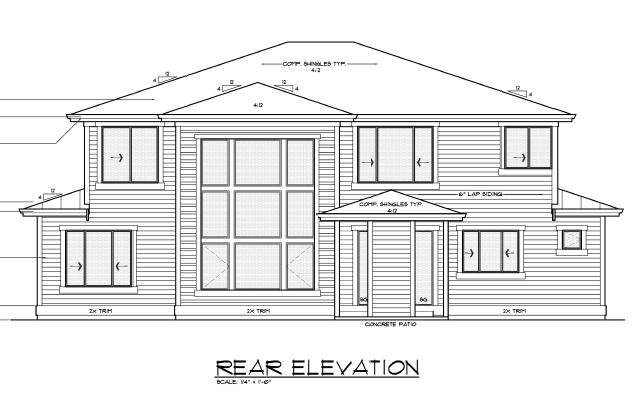

As Atlanta has become one of the hottest real estate markets in the country, Snellville has experienced growth. Historically, Snellville was limited to older homes, especially small ranch style homes with a decent amount of land, or large estate-like properties with large parcels of land. But many developers are taking advantage of the space and increasing the density.

In the last year home prices have seen an almost 10% increase from 2022, bringing the median sale price up to $380,000. Real estate developers are honing in on a target market of young families in search of a luxury style home under the $1M price point.

The comparable properties for this project support an ARV of $782,000 for each of the 5 properties. The ARV for the entire blanket loan is $3,064,000, and the loan amount extended to the borrower came in at $2,105,000. The whole construction budget is set at $1,996,000, breaking down to $512,000 for each home.

The borrower expects to complete construction within 12 months and will list each property for final sale prior to completion. Sam worked with the Underwriting team to consider the scope of work on this new construction project and extended an 18-month loan term length. Once this project is completed these borrowers will work with ABL on the rest of the neighborhood.

For more information about acquiring hard money for your fix and flips, new construction, or term rental loans, contact Sam today.

0 Comments