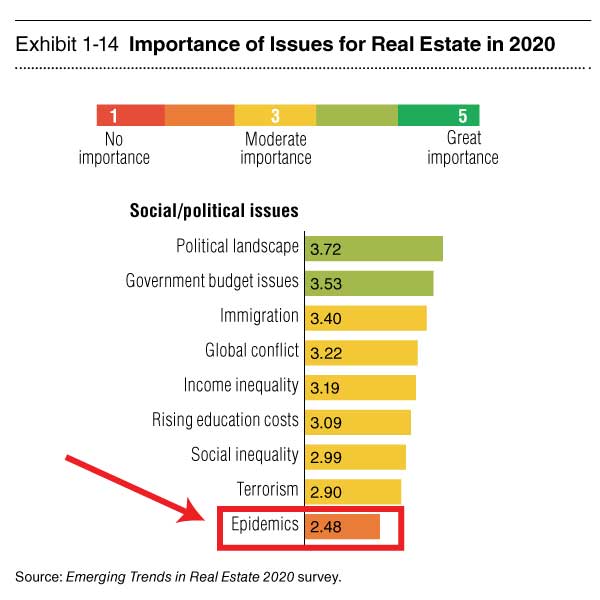

2020 has been a rollercoaster year, to say the least. Unprecedented times, new normal- all became cliché in a matter of weeks due to a shared experience occurring worldwide. Asset Based Lending, both its staff and its borrowers, certainly felt the effects of this year. Fortunately, not every effect was a negative one, with the real estate market surprising everyone by reaching record high numbers for investors and lenders alike.

ABL reached out to different borrowers, as well as its own staff, to help present a clear picture of COVID’s impact on real estate investing in 2020.

COVID Hits The United States

Immediately, ABL braced for the economic worst. Having been founded right after the subprime mortgage collapse of 2007, the company was no stranger to economic downturns and crises. Paul Ullman, co-founding partner of ABL and underwriter, recalls the start of COVID’s impact,

[su_quote]The first stage was disastrous with financial panic. Banks were pulling back credit, the stock market was dropping huge amounts, and people were going into hibernation.[/su_quote]“It came in stages- The first stage was disastrous with financial panic. Banks were pulling back credit, the stock market was dropping huge amounts, and people were going into hibernation”. Many hard money lenders began to close shop and stop lending entirely, causing a temporary standstill in certain real estate markets. The future of the economy, especially the real estate market, felt grim. However, Paul saw things differently, sensing a business opportunity that could be pursued from the safety of home. “We made a decision to stay the course- to not stop lending. We changed loan parameters, underwriting, and our perspective on the business.” ABL sent employees home in early March, equipping them with the tools they needed to safely work remote. Despite having just moved into a brand-new office near the water in Jersey City, NJ it was clear that the staff’s health needed to be protected above all else. It was also clear that the world was not entirely on pause and that real estate investors who were continuing to grind would need an active lender now more than ever to help secure their deals.

Although, closing deals was certainly not the first thought on anyone’s mind. When ABL began to reach out to its borrowers amidst the crisis, it was to check up on them. “When I talked to clients, it was to see how they’re doing- we’re humans first. (It was) Not about reaching out to close a deal or loan. We’re here to build real relationships,” said Zak Blechman, loan officer at ABL. Given the economic struggles that were starting to unfold, ABL expected many more delinquent loans than before. The ABL team worked quickly to put together a forbearance program, allowing current investors who were facing dire financial situations to reduce the level of interest on their active loans.

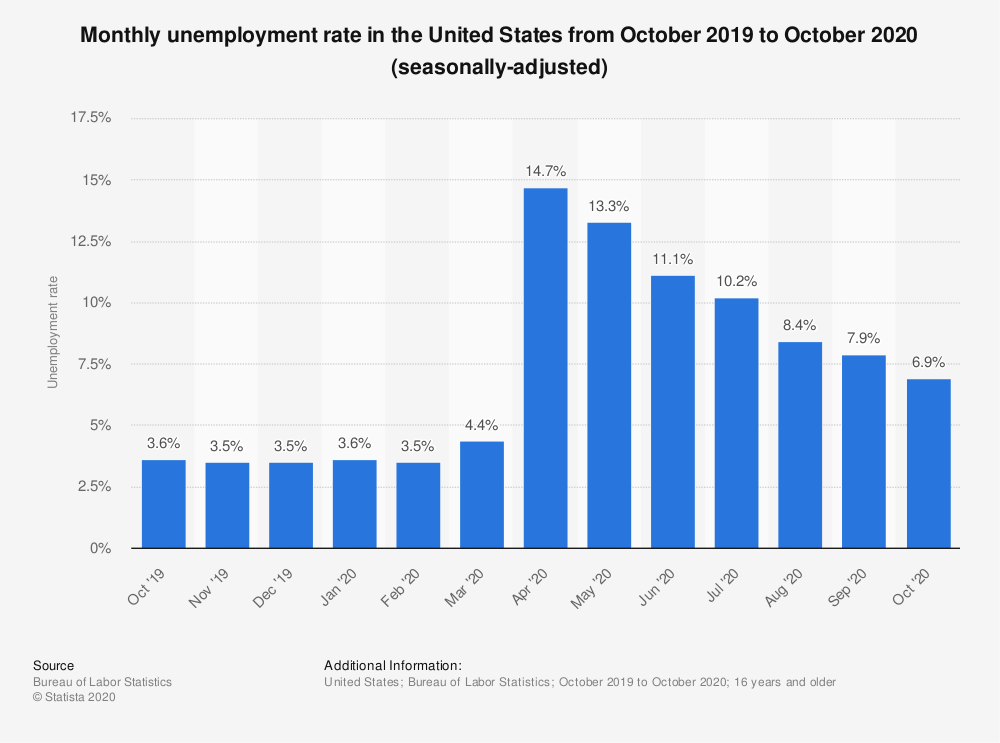

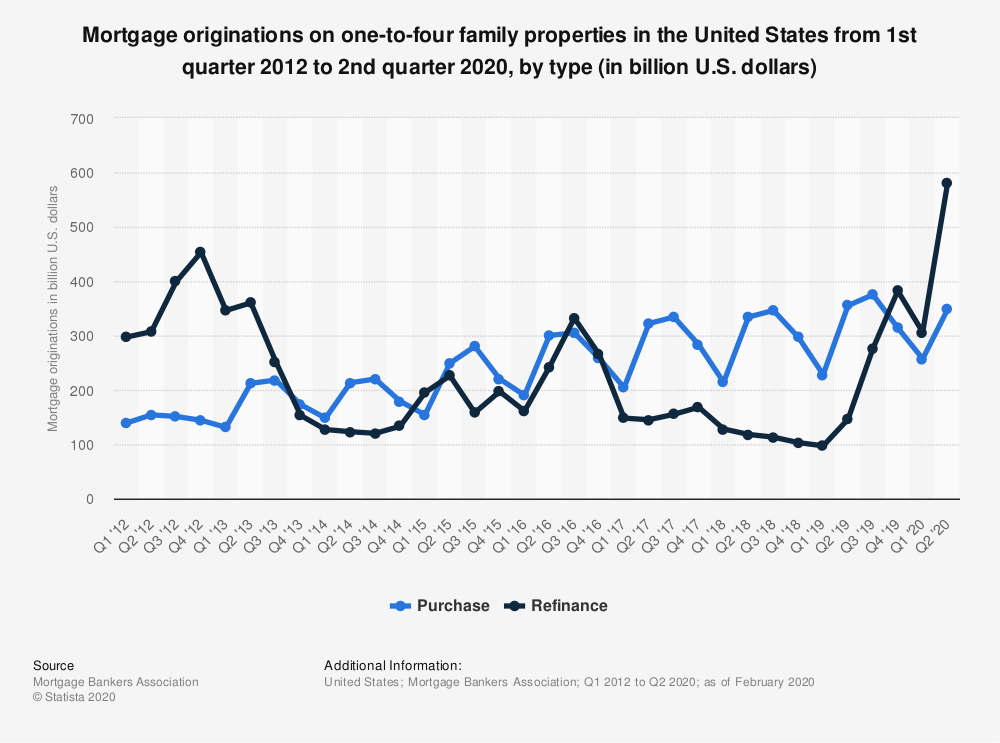

[su_quote]There were $1.1T loan originations in the last quarter (Q3 2020), a historical record. 30% of these loans were refinances, as people have been taking advantage of incredibly low rates. Interest rates are at historical lows – 2.8% on a 30-year fixed, the lowest it’s been in at least 50 years. [/su_quote]With some homeowners hunkering down thanks to better mortgage rates and others looking to sell fast to change their living situation, the market began a rapid shift to record low inventory shortage and record high sale prices.

The Real Estate Shuffle

Redfin reported that 40 of the 50 largest metro areas in the nation are experiencing housing shortages, with their decline in supply correlating to the very start of COVID’s panic in February. Areas like Newark, NJ and Frederick, MD which support New York City and Washington DC respectively, are seeing 20% decreases in housing supply from the previous year, putting the power into the hands of the home seller rather than the home buyer. Many homes are seeing sale prices well above the initial asking price, skewing the traditional negotiations of trying to cut a deal under market value. At the start of COVID, the most desirable homes in these metro areas at were seeing bids approximately $5,000 or $10,000 above asking price, but those numbers are now jumping to $20,000 or $30,000 above asking price for the same quality homes in the same areas.

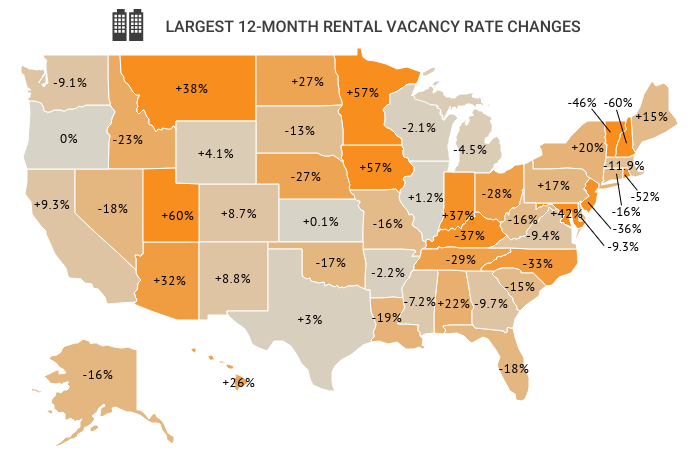

Meanwhile, the vacancy rate for rental property in New York City began to skyrocket after a few months. This trend was mirrored to various degrees in cities around the country, with massive waves of people looking to escape the expensive close quarters living that urban areas offered. Suddenly, suburban living became the hot trend. Manhattan reached an all-time vacancy high, tripling in number from the typical 2% vacancy to an astounding 6%, accounting for approximately 16,000 empty apartments and rising. Suburban areas within easy travel distance to urban areas and cultural centers, such as the New Jersey suburbs sitting beyond New York City’s borders, became prime real estate overnight. Kevin Rodman, ABL partner and underwriter, realized a few key components at play. [su_quote]It was a perfect storm- older millennials, who in previous generations would have already owned a home at this stage of life but were instead continuing to rent, were ready to pull the trigger on purchasing a property. Mix that with historically low interest rates on mortgages and the fact that people were starting to spend the vast majority of their time inside their homes meant this demographic was starting to buy up all the available suburban homes.[/su_quote]“It was a perfect storm- older millennials, who in previous generations would have already owned a home at this stage of life but were instead continuing to rent, were ready to pull the trigger on purchasing a property. Mix that with historically low interest rates on mortgages and the fact that people were starting to spend the vast majority of their time inside their homes meant this demographic was starting to buy up all the available suburban homes.”

The recent economic boom of the real estate market was a surprise for all- a complete opposite reaction to the 2007 crash. Hindsight helped piece together the why, but experts like Kevin were initially preparing for the worst. “It was exceptionally unexpected- the country was poised for a deep recession, but in fact, the opposite has occurred.” ABL’s books began to shift, but benefit, from the real estate market’s shift. Many new borrowers started reaching out, including first time investors, looking to take advantage of the market’s surge in prices. The level of competition has helped ABL acquire new clients, but it also started to box out some established investors. “Right now, our problem is that repeat borrowers are coming to us less and less because they can’t find the inventory that they used to.”

Fix And Flips Trending Downward

Due to housing inventory shortages driving up prices and many new home buyers seeking a primary residence, the marketplace for profitable fix and flips is shrinking daily. As of July, the housing inventory dropped for its twelfth straight month, reaching a record low of 1.9 million homes on market for the entire United States. Susan Botros, Vice President of Sales and loan officer at ABL, is seeing the fix and flip downturn in real time. “Before COVID, 1 out of 10 houses would make sense for an investor, but now its 1 out of 25.” Since investors are competing more than ever with other investors as well as primary residence buyers, she believes there is “not enough meat on the bone” compared to recent years.

Real estate investors who focused solely on fix and flips are having to accept lower profit margins to continue their business, putting in the same amount of work and focus for less money on closings. “Finding the right projects have become harder- profit margins decreased for flips. Investors usually want 15-20 percent (profit), but prices being driven up meant they were now looking at 10 percent,” said Zak.

One of ABL’s top borrowers, Cathy, has been involved in the real estate business for over 16 years. Her and her husband work as a team and each became full-time investors within the last 7 years, focusing their investments on the New Jersey real estate market. They started off with rental property near their primary residence and in more recent years started to delve into fix and flips as well as residential new construction. 2019 was their biggest investment year ever for gross profits, and 2020 was set to be an even bigger year for the duo. “Then the market just completely turned upside down when COVID hit.”

She began moving their investment money out of the city and into the suburbs. Where she previously held investments in urban areas like Jersey City, she was now switching to more suburban areas such as Montclair. Cathy told her husband, [su_quote]Its actually really good that we are a small business. We can move quickly in different directions and change strategy really quickly.[/su_quote]“Its actually really good that we are a small business. We can move quickly in different directions and change strategy really quickly.” The duo chose to double down on their role as landlords, placing more money into rental property investments and using the passive income to maintain their real estate business. With so much uncertainty surrounding the major metro areas like New York City, many people escaping to the suburbs are interested in renting instead of buying so that they aren’t locked into a singular location for the next several years. Plus, rental prices in these suburban areas have risen similarly to the prices for homes, making them stable and profitable choices during a fluctuating market.

As for the current state of fix and flips, Cathy believes that for her, “Flipping is off the table for now, for at least the next year.” She emphasized the importance of maintaining a strong network to help find off-market deals and take advantage whenever possible, especially in such a competitive marketplace. While fix and flips will still work if you find the right deal, its harder to find that right deal than ever before, so having a trustworthy network can help you maintain a competitive advantage over other investors with less resources.

New Construction Hotter Than Ever

Despite the cost of lumber doubling since the start of COVID, residential new construction is on an upswing that the country has never seen before. Since housing inventory is so low but demand is so high, new construction is the only way to guarantee that demands can be met. As of July, residential new construction projects were up over 23% from the previous year while buildings permit for new construction rose by over 9%. September saw a 5-year high of 1,553,000 new residential housing permits registered in that month alone.

The current market trends are mirrored in ABL’s numbers. Residential new construction loans were approximately 20% of ABL’s active loans before COVID, sometimes dipping as low as 10% depending on the month and current market trends. As of this writing, roughly 30% of ABL’s active loans are for residential new construction with projections of increasing over the next six months as demand continues rising.

One of ABL’s borrowers in Florida, Dave, has been working in the real estate business for 32 years with the last 13 years being a full-time investor. He began investing in real estate after the market crash of 2007, taking advantage of the foreclosure market to turn a profit through fix and flips before entering the residential new construction market in 2015. Like the situation in the northeast, he saw the real estate business in Florida slowdown in the early months of COVID but pick right back up again post-stimulus. As of November, the Florida real estate market is so hot that Dave can barely keep up with demand. “If it’s a decent investment, it’s gone in 5 minutes down here.” With fix and flips becoming less profitable than years past and new construction becoming so hot, Dave is thankful that he entered the new construction market when he did. Despite a brief slowdown in late 2018, his residential new construction investments have only ticked upward and are now skyrocketing in 2020 due to COVID. [su_quote]Everything is sold at the planning phase- nothing makes it to completion.[/su_quote]“Everything is sold at the planning phase- nothing makes it to completion.” At the time of writing, the hot market is allowing him to start construction on 3 different houses next week- all three are already accounted for with buyers. For his fellow investors in Florida and other areas seeing similar market trends, he offered the following advice, “Don’t be faint of heart. If you find an investment property that is slightly more than you want to pay for it, do it, because the market is so hot right now.”

Another ABL borrower, Mike, has been investing in real estate in the south east since 1992. Ranging from Tennessee down to Florida, his bread and butter investments are in residential new construction. With nearly 30 years of experience under his belt he has seen it all, but having to close a deal outside in a public park while socially distanced and wearing a mask was a first for him. “I was able to close with a mobile notary and closed outside on a picnic bench. One of the documents needed a second witness, so we had to grab a random guy at the park. All socially distanced, with gloves and masks on.” Mike noted that business has seen an increase since the start of COVID with the only real negative being compression of the supply chain having an impact on construction supplies arriving on time, causing minor delays on some projects. Otherwise, his business has been booming in Florida and throughout the south east thanks to the influx of new home buyers leaving the big cities. Mike remains thankful that ABL continued to lend and honor active deals throughout the pandemic, saying, [su_quote]One loan was closed after the country shut down the first time. Everyone was scrambling- ABL still had a willingness to move forward on the deal, which removed a layer of uncertainty.[/su_quote]“One loan was closed after the country shut down the first time. Everyone was scrambling- ABL still had a willingness to move forward on the deal, which removed a layer of uncertainty.” He emphasized that investors should continue to do their homework and understand the market conditions, so they can capitalize on the opportunities being presented.

What Does The Future Of Real Estate Hold?

As of this writing, residential new construction continues to remain the hottest trend for real estate investors with no signs of slowing down. Even with record high lumber prices eroding the profit margins, the near-guaranteed home sales at above asking price is enough to keep the investments profitable and chainable, allowing savvy investors to put together several deals in a short time frame. One ABL borrower named Rich can’t keep his new construction projects on the market. He began real estate investing in 2009 and entered residential new construction in 2014. After ramping up in 2020 to construct approximately 25 houses, the success from this year combined with hot market has him projected to put up 40 news homes in 2021. “50 percent of my homes are sold before the certificate of occupancy- the market is just on fire right now.” Real estate investors with the capital and network to construct quality residential property should be taking advantage of the current market by investing to meet the ever-growing demand.

Asset Based Lending Holding Strong And Pushing Forward

Asset Based Lending is still working diligently from home. While we hope to finally use our new Jersey City office to its full effect soon, we continue putting the health of the staff and their families first and foremost. The team continues to maintain their strong relationships with borrowers and are constantly updating loan programs to help borrower’s secure good deals with strong profit margins. Zak believes the staff at ABL grew even stronger than before, to the benefit of the borrowers. “The internal team- processing, draw team, underwriters, had clear communication and never missed a beat. We became a stronger internal team, which led to a better external product that benefits our borrowers.”[su_quote]The internal team- processing, draw team, underwriters, had clear communication and never missed a beat. We became a stronger internal team, which led to a better external product that benefits our borrowers.[/su_quote]

The shared passion and hard work between teams to continuously push the company forward has resulted in ABL returning to pre-COVID business levels as of October, funding 57 different loans for a total of 15.75 million in proceeds that included fix and flips, residential new construction, and rental refinances.

ABL also received over $10 million in loan payoffs and processed 80 individual construction draws throughout the month. We’re proud to say that we never stopped lending throughout 2020, working diligently with borrowers to ensure their investments were funded and secure despite a global pandemic. With overall business returning to normal and borrowers starting to shift their investment strategies to match the change in the market, ABL is ready to continue funding successful real estate investments through 2021 and beyond.

0 Comments