Meet the hard money loan deal estimator for fix and flip investors.

For experienced and beginner investors alike, quickly vetting the potential profitability of a new fix and flip investment is an essential skill to have. Unfortunately, it can be hard to keep track of the different potential scenarios involved in financing a new investment – not to mention simulating how various deal points impact the overall economics.

[su_youtube_advanced url=”https://www.youtube.com/watch?v=TZGPaYuEe9Q” width=”740″ height=”420″ controls=”alt” showinfo=”no” rel=”no” modestbranding=”yes”]

Enter: The Fix And Flip Deal Economics Estimator

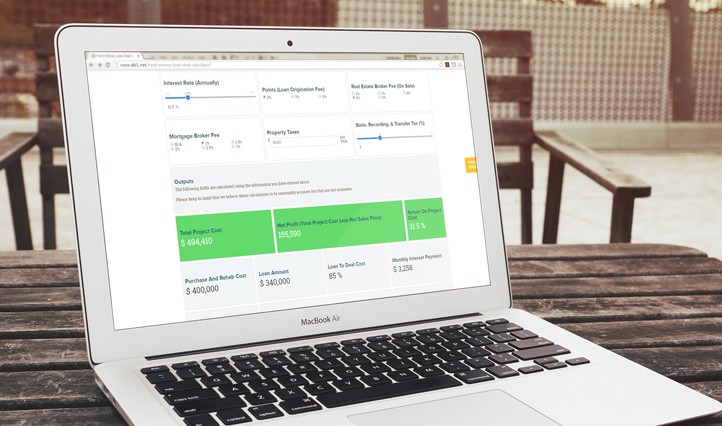

This week, Asset Based Lending launched the first web-based version of our deal economics analysis tool. For years, ABL has been using a spreadsheet version of the calculator to help potential borrowers dig into their financials and truly understand if their deal looks like a sound investment decision.

What Does It Do?

The goal of the deal calculator is simple: let potential investors enter some basic deal points and estimate how much money they truly stand to make from their investment, as well as what their significant costs will be.

Investors begin by entering the property purchase price, planned rehab (or renovation) budget, and approximate after repair value (ARV).

Next, the calculator asks the user to estimate some of the terms and costs related to their hard money financing and taxes. Although information like the hard money lender’s interest rate and points are decided by the lender, it is helpful for the investor to be able to simulate different financing scenarios.

The inputs required by the calculator are:

- Purchase Price

- Rehab Budget

- After Repair Value

- Advance As A Percent Of Purchase (What Percent Of Purchase Price Is Covered In The Loan)

- Turnaround Time (How Many Months From Loan Close To Sale)

- Interest Rate

- Loan Points

- Real Estate Broker Fee (On Sale)

- Mortgage Broker Fee

- Property Taxes

- State, Recording, And Transfer Taxes

Results

As the user enters their data into the calculator, various formulas are applied in the background that result in the “Outputs” section of the page. From here, users can see the total cost of the project, the loan amount, their estimated net profit, and the various other calculations that go into coming up with those results.

The outputs provided by the calculator are:

- Total Project Cost

- Net Profit (Total Project Cost Less Net Sales Price)

- Return On Investment (Return On Project Cost)

- Purchase And Rehab Cost

- Loan Amount

- Loan To Deal Deal Cost

- Monthly Interest Payment

- Points Cost

- Total Interest Cost

- Real Estate Broker Fee (On Sale)

- Mortgage Broker Fee

- Approximate Property Insurance

- Approximate Title Insurance

- State, Recording, And Transfer Tax

Ultimately, the deal calculator generates reasonably accurate estimates of a deal’s profitability and provides critically important information to a real estate investor considering whether or not to move forward on a project. For even better results, discuss your scenario with one of our loan officers who can help you more accurately estimate your financing costs.

0 Comments