The Deal: Property Purchase & Rehabilitation in Brookline, MA

Today’s deal comes from Michael Chadwick, who closed this fix and flip hard money loan in Brookline, MA. The property was purchased for $2,300,000 with a renovation budget of $450,000 and a total loan funded at 87% LTC. The borrower is an experienced real estate investor that is working with Asset Based Lending for the first time.

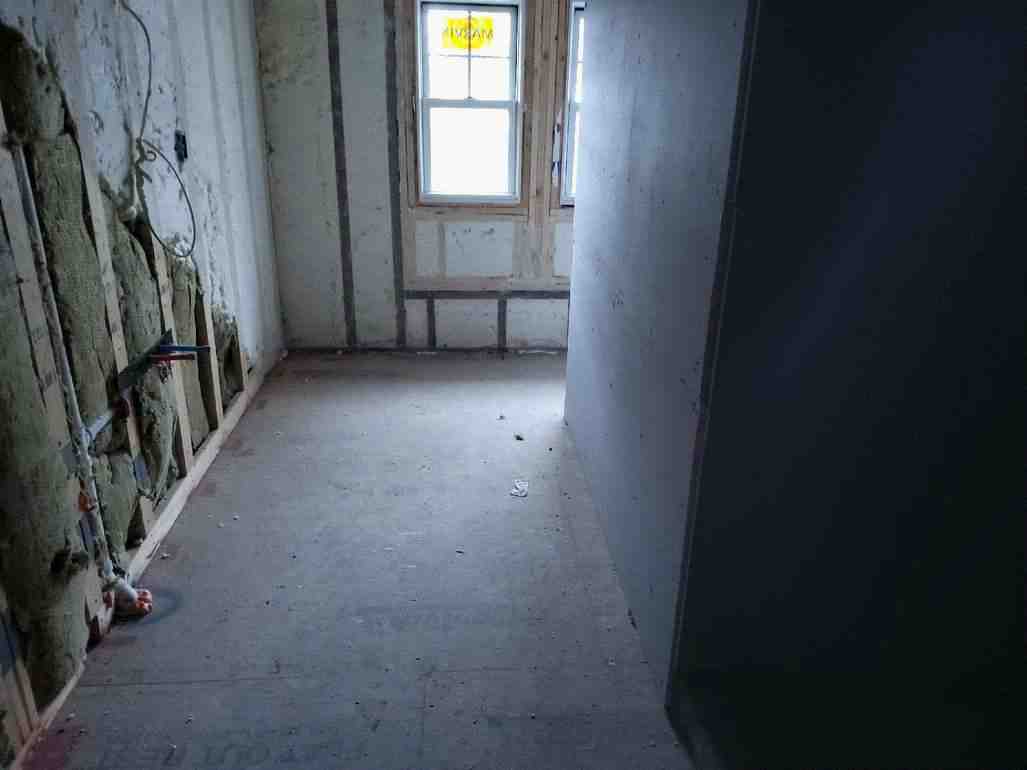

The renovation is a condo conversion that will see four townhouse units converted into two high-end condos and be sold individually for approximately $1,800,000 each. The two condos will be mirrors of each other with 4-bedrooms, 3.5-bathrooms measured at 2,350 square feet each. Each condo will have four floors of living space with two master bedrooms. Exterior highlights will include new roof, new siding, new windows, and new walkaway around the perimeter. Interior highlights will include luxury finishes to the kitchen and bathrooms, natural oak flooring, gas fireplace, and high-end appliances. The project is expected to be complete within three months and final sale expected within two months after.

About Brookline Massachusetts

I’m always impressed by the speed and efficiency of our ABL team, but the ability to approve and close loans that are time sensitive can’t be understated. This deal would have never happened.

Brookline is an upper-class suburb outside of Boston that has seen strong growth in its real estate market over the last decade but especially in the last year. As of April 2021, the average home sale price reached $945,000 which is a 14% increase from the year before and represents a five-year-high. 55 homes sold during the month of April, marking a 68% increase in home sales for the area compared to the previous year. Homes are spending an average of 34 days on market which indicates a hot seller’s market and a strong stat for fix and flip investors and builders looking for their next Massachusetts deal. For comparison, a balanced market sees homes spend an average of 60-90 days on market.

Mike is proud of the ABL team’s effort to come together and close deals quickly when it counts, delivering a five-star experience to every single borrower. “I’m always impressed by the speed and efficiency of our ABL team, but the ability to approve and close loans that are time sensitive can’t be understated. This deal would have never happened,” said Mike. Mike covers the Massachusetts and other New England markets, bringing two decades of experience and market knowledge to our borrowers in the area. If you’re looking for hard money loans for fix and flips or new construction, or are interested in our term rental loans, then contact Mike today.

0 Comments