Asset Based Lending is proud to celebrate our borrower’s successful real estate investments and our loan officers who facilitate that success. ABL will be highlighting our loan officer’s favorite deal each month, going through the details that made it a win and how our experts navigated the process.

The Deal: New Construction in Jersey City, NJ

Today’s deal comes from Zak Blechman, who closed this hard money new construction loan in Jersey City, NJ. The parcel of land was purchased for $132,500 and included a church that was zoned for residential and will be transformed into condominiums. The total loan amount came to $946,000 and was funded at 79% LTC. Construction costs are budgeted at $1.2 million. The borrower’s exit strategy is to rent the condominium units until they are eventually sold with an estimated ARV of $2.1 million.

The borrowers are a team of experienced real estate developers that focus on Jersey City and the surrounding areas. They put tens of thousands of dollars of their own money into the start of the construction project and were relying on another private money lender to fund the remainder. At some point, the other lender became unreliable and refused to fund the ongoing construction loan. Thankfully, Zak had been following up with the investors regularly to continue building the relationship and found out they needed a new lender quickly. Zak worked fast with the rest of the ABL team to fund the current construction, closing the deal in less than two weeks with a new scope of work. Zak has been a fan of the duo’s construction projects and the location they build in, saying, “They’re redeveloping a specific area of Jersey City that provides buyers a new product with high-end finishes.”

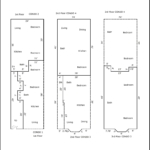

The existing property was formerly a church that was zoned to be a two-family multi-family rental home. The property was later rezoned for a multi-family 4, so the investors decided to change the construction plan to become a four-unit condominium. The property is undergoing complete gut renovations to complete the transformation into multi-family housing. This 4-unit condo will be divided into three floors, with the two ground floor units being 2-bedrooms, 1-bath measured at 872 and 776 square feet, respectively. The other two units will be duplexes split between two floors featuring 4-bedrooms, 2-baths measured at 1579 and 1728 square feet. These units will include high-end finishes to appear best on market, highlighted by qualities such as hardwood oak floors, marble baths, and Italian cabinets.

The Jersey City Real Estate Market

According to Redfin, the average sale price for homes in Jersey City is currently $570,000, which is a slight 1.6% decrease from the previous year. However, the average sale price per square foot is now at $470, which is a nearly 12% increase from the previous year and explains the increase in new construction that the area is seeing. Typically homes in the area are on the market for 38 days and sellers are receiving two offers on average before the final sale, giving them a little bargaining power with the sale price. 191 homes sold during October 2020, highlighting a healthy seller’s market that is currently favoring new construction projects over fix and flips. New residential construction is on the rise throughout the entire country, with record breaking numbers of residential construction permits being submitted in October, with traditionally rental-focused cities such as Jersey City seeing that same level of change.

Zak’s Insight

Zak values his relationship with ABL borrowers, focusing on getting to know investors and finding ways he can help them continue their successful real estate investing. His dedication and follow-through helped save this borrower money and continue construction, showing them the seamless nature of ABL loans.

Because of the newfound relationship, reliability, and speed, we’ll be working with them for the foreseeable future

“Because of the newfound relationship, reliability, and speed, we’ll be working with them for the foreseeable future,” he said. If you’re looking for hard money loans in New Jersey for new construction or fix and flips, contact Zak today.

0 Comments