Reliable Private Hard Money Lenders In Colorado

Join thousands of real estate investors across the country that

trust ABL to be their lending partner.

Direct balance sheet lender

Home of the Zero-Point Loan

Close in 2 weeks or less

Fix & Flips, New Construction, Rentals, & Multi-Family

One-stop-shop for BRRRR loans

Up to 90% LTC

100% construction/rehab financing

Finance Your Investment

The Premier Colorado Hard Money Lender

Asset Based Lending recently expanded into Colorado, bringing over a decade of hard money lending experience to The Centennial State. ABL has funded over $2B in hard money loans over the last ten years, providing fast and reliable financing to real estate investors across the country. We offer Colorado hard money loans for fix and flips, new construction, cash out refinances, and long term rental property. Our teams specialize in closing deals quickly so our borrowers never miss an opportunity, with our average loan closing in just 10 days. As a direct hard money lender in Colorado, we utilize flexible underwriting to provide investors with their perfect loan scenario whether they’re looking for lower interest rates, maximum leverage, zero points, or something else.

We focus on the local Colorado real estate markets, understanding that a fix and flip loan in Colorado Springs needs to be written differently than a Denver new construction loan. These nuances allow us to offer borrowers the best hard money loan for their exit strategy, tailoring each loan to match your specific needs. Our loan programs in colorado are designed for investors to quickly and efficiently scale their real estate business, allowing them to move swiftly from deal to deal and maximize their potential profits every single year. Our hard money lenders in Colorado work with investors of all experience levels, whether you’re looking to expand your current rental portfolio or want to start your first fix and flip. Asset Based Lending is ready to fund your next success, so contact us today to be pre-approved for your Colorado hard money loan and experience the ABL Difference.

Prequalify Today

Prequalify for your loan in Colorado today or call us at (201) 942-9090. We approve loans as fast as 24 hours. Our Colorado private money loans can fund the following projects:

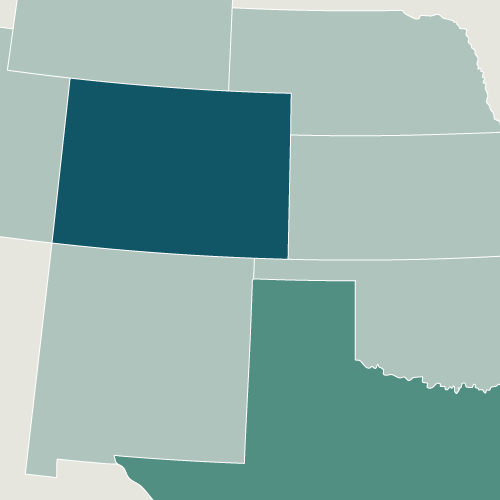

ABL Lends in: ABL lends in all of non-rural Colorado, pending property and borrower underwriting

Seth has been involved in private capital industries for 20 years, becoming an expert in finance and lending. For the last 7 years, he has been helping real estate investors finance their projects, with a strong focus on speedy closings. Seth specializes in building strong relationships, analyzing deals, and quickly determining suitability for his clients.

Coming Soon.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

INCREASE IN MULTI-FAMILY BUILDS

AVG FIX & FLIP PROFIT

POPULATION GROWTH

HOMES SOLD ABOVE LISTING PRICE

Recently Funded Projects

Colorado Hard Money Loans For Real Estate Investors

Hard Money Loans Designed For Local Investors

Asset Based Lending has been helping real estate investors for more than 12 years now, specializing in fast and flexible hard money loans that allow investors to scale their business quickly and efficiently. As investors ourselves, we pride ourselves on providing the most borrower-friendly hard money loans on the market. ABL uses a fully in-house team for our bridge and term loan programs while partnering with the best local appraisers, attorneys, and title agents in our lending areas. Our goal is to deliver a seamless loan process from start to finish, as highlighted by our hundreds of five-star reviews. After you experience the ABL Difference, you’ll never use another Colorado hard money lender.

Financing Your Colorado Fix And Flip

Asset Based Lending specializes in fast financing for fix and flip investors in Colorado. We’re able to close our rehab loans in 10 days or less on average, so you’ll never miss out on a potential deal. These 12-month interest-only bridge loans allow Colorado investors the ability to acquire property and begin renovating with the most competitive rates on the market, including the industry’s only true zero-point program. ABL offers funding that covers up to 85% of purchase price and 100% of the rehab costs. Whether you’re working on your first fix and flip or a seasoned professional, ABL is ready to finance your flip. Click here to learn more about our Colorado fix and flip loans.

Loans For Colorado New Construction

High population growth combined with limited housing inventory has made Colorado new construction one of the most profitable investments in the country. ABL provides hard money loans for new construction to real estate investors that are seeking competitive interest rates, fast draw turnarounds, and flexible underwriting. These 12-month new construction bridge loans are available to experienced investors, builders, and developers who can borrow up to 70% of the land value and 100% of the construction costs. ABL tailors our ground up construction loans to match each individual project, ensuring the borrower receives the best loan terms for their business strategy. We assess the investor’s experience level and the viability of the project to determine whether the deal is profitable for all partiers. Click here to learn more about our Colorado new construction loans.

Colorado Rental Property

Asset Based Lending offers simple and reliable Colorado rental loans. These term rental loans are designed for buy and hold investors that want to secure properties between 1-8 units or refinance an entire rental portfolio. We offer competitive terms with rates starting as low as 6% with leverage up to 80% LTV. Our goal is to provide the most flexible rental loan options to our borrowers including 30-year amortization, ARM, and interest-only options. ABL offers a variety of rental loan options with single rental loans up to $3M and rental portfolio loans up to $3M. These loans for rental property are available to investors of all experience levels, assessing each deal based on the income-producing viability of the property. Our team are experts in local Colorado real estate markets, giving us a deep understanding of the rental demand and ever-changing market rates. If you’re ready to start or grow your real estate rental portfolio using our Colorado rental loans, then contact us today.

Why Choose ABL?

Local Experts Who Know Your Market

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.