Missouri

The Premier Missouri Hard Money Lender

Financing your real estate investment should be quick and simple, so you can focus on the project at hand instead of worrying about capital. Asset Based Lending offers fast and reliable hard money loans for real estate investors across Missouri for fix and flips and new construction, as well as cash out refinances and loans for rental property. ABL uses a fully in-house team for our bridge and term loan programs while partnering with the best local appraisers, attorneys, and title agents in our lending areas. Our goal is to deliver a seamless loan process from start to finish, as highlighted by our hundreds of five-star reviews. After you experience the ABL Difference, you’ll never use another hard money lender.

- Quick closings – as fast as 2 days with appropriate paperwork

- Flexible underwriting – loan programs designed for investors, by investors

- Transparent communication – no hidden fees or surprise costs

- Full service – a one-stop shop for all your lending needs

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9090. We approve loans as fast as 24 hours. Our Missouri private money loans can fund the following projects:

Coming Soon.

Coming Soon.

Experience The ABL Difference

See why thousands of local real estate investors trust ABL to be their real estate financing partner.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

HOME OWNERSHIP RATE

AVG FIX & FLIP PROFIT

RES. CONSTRUCTION PERMITS ISSUED

UNEMPLOYMENT RATE

Local Information For Missouri Real Estate Investors

Missouri’s local real estate markets have grown substantially over the last few years, with the metro areas surrounding St. Louis and Kansas City being some of the biggest benefactors. The average home sale prices have risen year over year for the last five years, and current average sale prices are at a five-year-high for the state. As of August 2022 the average home sale price reached $252,500 which is slightly more than an 8% increase year over year. Homes are spending an average of 14 days on market, which is 6 less days than the previous year and highlights the fast-moving nature of the current market. Number of homes sold for the month are 8,205, a slight drop from the previous year and an indicator of a market correction versus a market downturn. Currently there are 24,081 homes for sale in Missouri which represents approximately two months of available inventory, meaning the state is in a seller’s market that benefits real estate investors. More than 99% of homes sold received their initial asking price in full, meaning sellers have an advantage during the negotiation process and can essentially plan their project’s final sale price ahead of time. With demand outpacing supply and average sale prices continuing to rise, investors should consider Missouri for their next fix and flip, new construction, or rental property investment.

Recommended Neighborhoods For Missouri Real Estate Investing

Asset Based Lending are experts in local Missouri real estate markets, reviewing trends and shifts to better inform our borrowers while providing the best possible loan terms for each project. Compiling data from Redfin, public town records, and local news sources, we believe some of the best Missouri neighborhoods for real estate investors are:

Chesterfield This suburb of St. Louis is the heart and soul of local culture, with a beautiful view of the Missouri River. This highly desirable Missouri location can see its high points reflected in the rising real estate prices and strengthening local economy. The average home sale price for the area is $497,500 which represents a 12% increase year over year. Only 62 homes are available for sale which is a 38% decrease from the previous year and highlights the active demand in the area that’s leaving gaps in inventory, which new construction could take advantage of. Nearly 70% of the homes sold are receiving more than the initial asking price, so seller’s have the upper hand in negotiations. As of August 2022, the area is boasting an unemployment rate of 1.7%, an attractive statistic for investors looking to grow their money over time.

Columbia Sitting almost exactly in the middle of the two major metro areas is Columbia, home to the University of Missouri. The high demand for student housing as well as the consistent number of jobs being brought to the area through the college and other local employers has helped boost the real estate market. Tourism has also increased in the area thanks to the university’s increasing reputation and city continuing to capitalize on its growth with increased attractions and its developed downtown area, making short term rental properties such as Airbnb a strong investment. Currently the average sale price for the area is at $247,000 which marks a 6% increase year over year. Highly desirable homes are selling as quickly as nine days from the initial listing date and can sell upwards of 7% above the asking price, making it an excellent location for both fix and flips and new construction projects.

Raymore This suburb of Kansas City has benefited from the metro area’s growth over the last few years, boasting a nearly 22% year over year increase in its average home sale prices. With the current average sale price at $365,000 marking a five-year-high for the area, homes are selling in only 13 days on average, making this location highly competitive and highly lucrative for real estate investors. The area has seen its job market increase by 1.3% over the last year, with a projected 10-year-growth of 33%, making this an excellent location for growing your money over time through real estate investments. Whether its taking advantage of the growing rental market or capitalizing on the rising home sale prices through flips or new construction, Raymore is a top area for Missouri real estate investors.

Recently Funded Fix & Flip Projects

Financing Your Missouri Fix And Flips

Asset Based Lending specializes in fast financing for fix and flip investors with a focus on flexible underwriting that allows us to work with several different types of rehab projects. We’re able to close our rehab loans in 10 days or less on average, so you’ll never miss out on a potential deal. These 12-month interest-only bridge loans allow Missouri investors the ability to acquire property and begin renovating with the most competitive rates on the market, including the industry’s only true zero-point program. ABL offers funding that covers up to 85% of purchase price and 100% of the rehab costs. Whether you’re working on your first fix and flip or a seasoned professional, ABL is ready to finance your flip. Click to learn more about our Missouri fix and flip loans.

Why Missouri Investors Choose Fix And Flips

Fix and flips are one of the most consistent and reliable forms of real estate investing, offering profits that allow investors the ability to funnel that capital into their next projects. Right now Missouri fix and flips are on the rise, with a total of nearly 8% of home sales in the state attributed to flips. Missouri fix and flip investments are seeing an average profit of $32,894 as of Q1 2022 More than one-third of real estate investors use outside financing for their projects, with hard money lenders being the preferred choice for bridge loans since investors can both close and exit the deals quickly. Our fix and flip loans in MO focus on closing in 10 days on average so our borrowers never miss an opportunity due to financial delays. Whether you need to close fast, are seeking flexible loan terms, or another lender simply dropped the ball, ABL is here to help.

Using Hard Money Loans For Fix And Flips

Financing a fix and flip investment requires a lending partner that can close fast and offer a variety of loan options. That’s why so many real estate investors prefer hard money loans for fix and flips, as this type of financing can close in less than two weeks and comes with flexible loan terms. For example, Asset Based Lending has closed loans as quickly as two business days with the appropriate paperwork. These speedy loans allow fix and flip investors the opportunity to secure deals that would normally be missed if using another financing option. Hard money loans are also less stringent with its documentation requirements- aside from recent bank statements and a credit check, hard money lenders forego documents such as tax records or income verification. Investors that have tried borrowing from a bank or other traditional financial institutions know the pushback- the projects are inherently risky and banks typically don’t want to involve themselves in these types if projects. Or if they do choose to lend, its an agonizingly long process with enough loan stipulations, such as prepayment penalties or intensive documentation requirements, that ends up hurting the deal too much from the investor’s point of view. When it comes to fast and efficient lending for fix and flips, hard money loans are the best option for borrowers, and no lender does it better than Asset Based Lending.

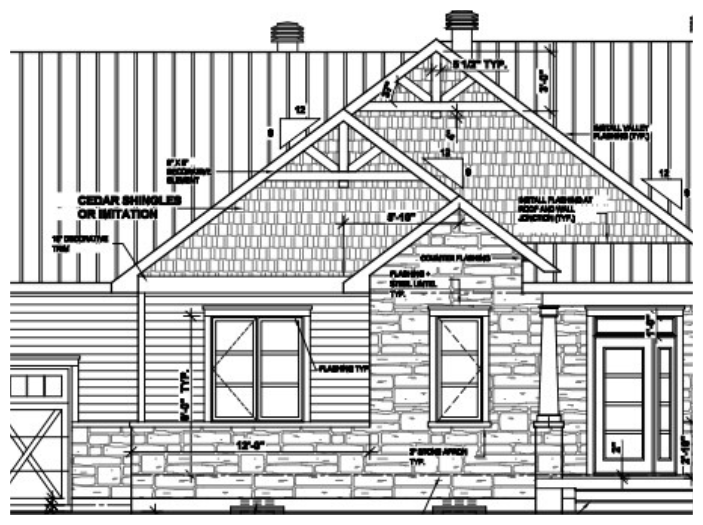

Recently Funded New Construction Projects

Loans For Missouri New Construction

ABL provides hard money loans for new construction to real estate investors that are seeking competitive interest rates, fast draw turnarounds, and flexible underwriting. These 12-month new construction bridge loans are available to experienced investors, builders, and developers who can borrow up to 70% of the land value and 100% of the construction costs. ABL tailors our ground up construction loans to match each individual project, ensuring the borrower receives the best loan terms for their business strategy. We assess the investor’s experience level and the viability of the project to determine whether the deal is profitable for all parties. Whether you’re looking to finance the ground up construction of single family or multifamily projects, ABL is ready to discuss your upcoming deals. Click to learn more about our new construction loans.

Missouri New Construction Investment Info

Steady population growth combined with limited housing inventory has made Missouri new construction one of the most profitable investments in the state, providing the supply needed to meet increased demand. The number of building permits issued for new single-family homes in St. Louis increased by more than 3% year over year, with areas such as Franklin County seeing double-digit increases. Over 5,000 multifamily units were under construction in St. Louis in Q1 2022, with the price per unit jumping over 24% from the previous year. The strong local economy and demand for housing helps fuel these types of increases, which builders and developers can take advantage of. The state’s housing supply is hovering around one month, which is far below the minimum three month supply needed to indicate a balanced market. Right now, demand is far outpacing supply, which has led to a 5% decrease in newly listed homes over the last year. Builders and developers can take advantage of these market conditions by filling the gaps in inventory and profiting from the seller’s market the state finds itself in. If you’re ready to use Missouri construction loans to scale your real estate business, then contact us today.

Choosing Asset Based Lending For New Construction Loans

The constant feedback from investors that utilize ABL hard money loans for new construction is the fast time to close and loan flexibility are part of their project’s success. A slower close time or stricter loan parameters would hurt their ability to scale their real estate business as quickly as they would like. By securing financing quickly with terms that are investor-friendly, builders and developers are able to leverage ABL construction loans to their advantage and control more of the market share in the areas they invest in. While some investors seek out bank financing or private money loans, they realize the slow nature and strict guidelines of bank loans or lack of reliability from a private money lender ends up costing them deals or causing more issues instead of making things easy. Working with a lender that’s ready to work as fast as you is invaluable, ensuring you can grow and scale your real estate business at whatever pace you’re comfortable with. Asset Based Lending is run by real estate investors, so we strive to create a seamless loan process that allows investors to receive their financing quickly and focus on the project at hand. As direct hard money lenders with full control of our capital, we’re able to lend on various new construction investments and use flexible underwriting to ensure our borrowers receive their best potential loan. Whether you’re looking to build a few homes a year or you’re ready to scale to multifamily development, then contact us today to discuss your upcoming projects.

Loans for Missouri Rental Property

Asset Based Lending offers simple and reliable Missouri rental loans. These term rental loans are designed for buy and hold investors that want to secure properties between 1-8 units or refinance an entire rental portfolio. We offer competitive terms with rates starting as low as 6% with leverage up to 80% LTV. Our goal is to provide the most flexible rental loan options to our borrowers including 30-year amortization, ARM, and interest-only options. ABL offers a variety of rental loan options with single rental loans up to $3M and rental portfolio loans up to $3M. These loans for rental property are available to investors of all experience levels, assessing each deal based on the income-producing viability of the property. We also offer the ability to use our bridge program to complete property rehab or finance ground up construction before refinancing into a long-term rental loan, making us a one-stop shop for Missouri real estate investors. Click to learn more about our rental loan programs.

Missouri Rental Markets

The large metro areas such as St. Louis and Kansas City are contributing to Missouri’s strengthening rental market, offering affordable rental property that’s seeing consistent year over year growth. For example, St. Louis has seen an 11% year over year increase in its average rent prices, and with 54% of the city’s population renting versus owning its an attractive location for real estate investors looking for their next rental property. Kansas City is in a similar situation, with a 10% year over year increase in its average rent prices. The city has a slightly lower rental population of 46%, but that won’t impact the ability to fill vacancies as demand for the area continues to rise and prices remain at an affordable cost compared to the local economy. As mentioned earlier, areas like Columbia are benefitting from increased tourism thanks to a developed and University of Missouri bringing a steady stream of visitors throughout the year. This consistent flow of temporary residents are boosting the short term rental market in the area, making Airbnb and Vrbo properties a viable investment strategy. Whether you’re looking to buy and hold property for traditional long-term rentals or are interested in growing a small portfolio of short term rental properties, Asset Based Lending can help finance your success. If you’re ready to start or grow your real estate rental portfolio using our Missouri rental loans, then contact us today.

Why Choose ABL?

Local Experts Who Know Your Market

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.