Washington

The Premier Washington Hard Money Lender

Asset Based Lending provides fast and reliable loans for Washington real estate investors, focusing on quick closings and flexible underwriting to ensure our borrowers receive the best possible financing for their projects. We have programs to fund fix and flips and new construction, as well as cash out refinances and loans in WA for rental property. ABL utilizes a fully in-house team while partnering with the best local appraisers, attorneys, and title agents to ensure you receive a five-star experience every time. After you experience the ABL Difference, you’ll never use another private hard money lender in Washington State.

- Quick closings – as fast as 2 days with appropriate paperwork

- Flexible underwriting – loan programs designed for investors, by investors

- Transparent communication – no hidden fees or surprise costs

- Full service – a one-stop shop for all your lending needs

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9090. We approve loans as fast as 24 hours. Our Washington private money loans can fund the following projects:

Seth has been involved in private capital industries for 20 years, becoming an expert in finance and lending. For the last 7 years, he has been helping real estate investors finance their projects, with a strong focus on speedy closings. Seth specializes in building strong relationships, analyzing deals, and quickly determining suitability for his clients.

Coming Soon.

Experience The ABL Difference

See why thousands of local real estate investors trust ABL to be their real estate financing partner.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

HOME OWNERSHIP RATE

AVG FIX & FLIP PROFIT

RES. CONSTRUCTION PERMITS ISSUED

UNEMPLOYMENT RATE

Local Information For Washington Real Estate Investors

Washington real estate has seen major growth in the last few years, as the state’s strong economic offerings brought many new residents to the area. The total net gain for the state’s population growth was 83,300 between 2021 and 2022, which is a nearly 50% increase from the previous year. These new residents put demand pressure on local Washington real estate, driving up housing prices and making real estate investors very happy. As of November 2022 the average home sale price reached $567,000 which is a 1.5% increase year over year. Homes are spending an average of 29 days on market which indicates fast moving sales that benefit fix and flip investors as well as residential new construction projects. The number of homes sold during the month of November reached 6,673 which is down from the previous year and highlights the lack of available housing inventory due to ongoing demand.

There are currently only 5,309 homes for sale, which represents a two month supply for the state. Typically, a healthy real estate market has a minimum three month supply of inventory. Real estate investors can benefit from these market conditions, as fix and flip investors love the fast moving market while investors focused on new construction can fill inventory gap and use the heightened demand to sell their product at a premium price.

Recommended Cities For Washington Real Estate Investments

Asset Based Lending are experts in local Washington real estate markets, reviewing trends and shifts to better inform our borrowers while providing the best possible loan terms for each project. Compiling data from Redfin, public town records, and local news sources, we believe some of the best Washington cities for real estate investors are:

Seattle As private hard money lenders in Seattle, WA, we know that this is one of the best places to invest in real estate with major tech headquarters such as Microsoft and Amazon bringing thousands of high-paying jobs to the metro area. As of November 2022 the average home sale price reached $810,000 which marks a 5.2% increase from the previous year. The number of homes sold during the month is down year over year, as available inventory becomes more scarce due to high demand and a lagging new construction market. Seattle’s rental market is booming, with more than 55% of the area renting versus owning and the average monthly rent reaching a high of $2,334. Between the need for new construction and the high-value rental properties, real estate investors have opportunities for significant gains in the Seattle metro area.

Tacoma South of Seattle and also sitting along the water is another great city for real estate investors; Tacoma. As an emerging market compared to places like Seattle, the Tacoma real estate market is ripe for opportunity for real estate investors. The average home sale price reached $450,000 which is a 3% increase from the previous year. Homes are spending an average of 26 days on the market, making this another fast moving Washington real estate market. With a lower barrier to entry price than Seattle and quick moving deals, fix and flip investors may find profitable opportunities throughout the Tacoma area. This is a pretty competitive market, with more than 30% of homes selling above their listing price. To further highlight the demand for real estate, its currently estimated that Tacoma needs 45,000 new multifamily housing units by 2040 to keep up with the current demand trajectory, so builders and developers can excel in this emerging construction market. If you are interested in this growing market, contact the hard money lenders Tacoma real estate investors trust.

Spokane Located near the eastern border of the state, just a short distance from Montana, is Spokane, another great city for Washington real estate investors. The average home sale price reached $365,000 which marks a 7% increase from the previous year. Homes are spending an average of 22 days on market for yet another fast moving market in the state. This type of demand is occurring throughout the major metro areas of Washington, which each area offering different types of opportunities for investors. With the lowest average home price of cities on this list and homes spending such a short time on the market, Spokane fix and flips are an ideal investment. Inventory is scarce in the area, so its important to work with a fast moving hard money lender in Spokane, WA so you’re able to close on your your deal reliably.

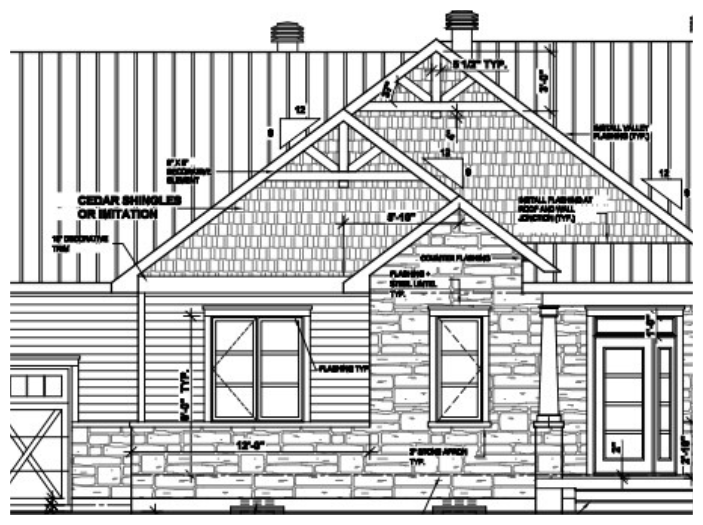

Recently Funded Fix & Flip Projects

Financing Washington Fix And Flips

Asset Based Lending specializes in fast financing for fix and flip investors with a focus on flexible underwriting that allows us to work with several different types of rehab projects. We’re able to close our rehab loans in 10 days or less on average, so you’ll never miss out on a potential deal. These 12-month interest-only bridge loans allow Washington investors the ability to acquire property and begin renovating with the most competitive rates on the market, including the industry’s only true zero-point program. ABL offers funding that covers up to 85% of purchase price and 100% of the rehab costs. Whether you’re working on your first fix and flip or a seasoned professional, ABL is ready to finance your flip. Click to learn more about our Washington fix and flip loans.

Why Washington Investors Choose Fix And Flips

Fix and flips are one of the most consistent and reliable forms of real estate investing, offering profits that allow investors the ability to funnel that capital into their next projects. Right now Washington fix and flips are on the rise, with a total of nearly 8% of home sales in the state attributed to flips. Washington fix and flip investments are seeing an average revenue of 29% of their total project as of Q2 2022. More than one-third of real estate investors use outside financing for their projects, with hard money lenders in Washington state being the preferred choice for bridge loans since investors can both close and exit the deals quickly. Our fix and flip loans focus on closing in 10 days on average so our borrowers never miss an opportunity due to financial delays. Whether you need to close fast, are seeking flexible loan terms, or another lender simply dropped the ball, ABL is here to help.

Using Hard Money Loans For Fix And Flips

Financing a fix and flip investment requires a lending partner that can close fast and offer a variety of loan options. That’s why so many real estate investors prefer hard money loans for fix and flips, as this type of financing can close in less than two weeks and comes with flexible loan terms. For example, Asset Based Lending has closed loans as quickly as two business days with the appropriate paperwork. These speedy loans allow fix and flip investors the opportunity to secure deals that would normally be missed if using another financing option. Hard money loans are also less stringent with its documentation requirements- aside from recent bank statements and a credit check, Washington hard money lenders forego documents such as tax records or income verification. Investors that have tried borrowing from a bank or other traditional financial institutions know the pushback- the projects are inherently risky and banks typically don’t want to involve themselves in these types if projects. Or if they do choose to lend, its an agonizingly long process with enough loan stipulations, such as prepayment penalties or intensive documentation requirements, that ends up hurting the deal too much from the investor’s point of view. When it comes to fast and efficient lending for fix and flips, hard money loans are the best option for borrowers, and no lender does it better than Asset Based Lending.

Recently Funded New Construction Projects

Loans For Washington New Construction

Asset Based Lending is proud to partner with experienced builders & developers as their financing for their new construction investments. Investors can use these 12-month interest-only bridge loans to finance up to 85% of purchase and 100% of construction costs for their project. ABL provides these Washington hard money loans to investors that have a proven track record of successful residential new construction, offering a variety of options including maximum leverage, lower interest rate, zero points, or something else. As direct private lenders in Washington State, we’re able to provide flexible loans that are written to match your specific business strategy, as long as it fits our criteria. Whether you’re looking to finance the ground up construction of single family or multifamily projects, ABL is ready to discuss your upcoming deals. Click to learn more about our Washington construction loans.

Washington New Construction Investment Info

The lack of housing supply in Washington is a major reason why the real estate markets are seeing such growth, especially with residential new construction. There were more than 22,000 residential permits issued throughout 2022, with the majority of focus on multifamily homes to help meet the ongoing demand for young families and professionals seeking rental property. Most of these new construction projects are occurring in the northwest and eastern parts of the state, with emphasis on the Tacoma and Spokane metro areas. Seattle metro is also booming with new construction, which makes sense as the capital of the state and center of commerce for Washington. Multifamily builds of four units or more are also rising throughout this city, as renting becomes more popular and for longer periods of time given the lack of available homes for purchase. Asset Based Lending can fund the construction of both single family and multifamily homes, offering fast and reliable financing for these investment projects.

Choosing Asset Based Lending For New Construction Loans

When it comes to fast and reliable funding, Washington real estate investors know to trust Asset Based Lending. Our track record speaks for itself, with more than half of our borrowers returning for repeat business and over $1.4B in loan origination since our company’s inception. We have fully in-house teams for the entire loan process, providing you a five-star service from start to finish. ABL approves loans as fast as 24 hours and closes loans a quickly as two days with the appropriate paperwork. This doc-light approach to new construction financing lets real estate investors scale their business faster than ever and with zero headaches. With the Washington real estate markets continuing to thrive and low housing inventory plaguing the most popular markets, now is the perfect time for builders and developers to take advantage of outside financing. By using hard money capital to fund their projects, they can move quickly and use the current market conditions in their favor. Asset Based Lending insists on a transparent lending process with no prepayment penalties or hidden fees, so you keep more of your money. Contact us today to be approved for your WA new construction loan.

Loans for Washington Rental Property

Asset Based Lending offers simple and reliable Washington rental loans. These term rental loans are designed for buy and hold investors that want to secure properties between 1-8 units or refinance an entire rental portfolio. We offer competitive terms with rates starting as low as 6% with leverage up to 80% LTV. Our goal is to provide the most flexible rental loan options to our borrowers including 30-year amortization, ARM, and interest-only options. ABL offers a variety of rental loan options with single rental loans up to $3M and rental portfolio loans up to $3M. These loans for rental property are available to investors of all experience levels, assessing each deal based on the income-producing viability of the property. We also offer the ability to use our bridge program to complete property rehab or finance ground up construction before refinancing into a long-term rental loan, making us a one-stop shop for Washington real estate investors. Click to learn more about our rental loan programs.

Washington Rental Markets

The major metro areas of Washington have always been strong rental markets thanks to the economic opportunities in the state, but in recent years they’ve really boomed into an excellent investment opportunity for buy & hold investors. The statewide rental vacancy is hovering around 4% which is far below the national average and highlights the strong demand for rental units throughout the state. Places like Seattle and Tacoma are in need of multifamily new construction to help fill the demand for rental units, while areas like Spokane are great areas for Washington newcomers to settle down for a few years with an affordable rental property. Seattle also makes a great tourist city and is the first place outsiders think to visit when they choose to visit Washington, leading to profitable year-round short-term rental markets using platforms like Airbnb and Vrbo to fill vacancies. Whether you’re looking to buy and hold property for traditional long-term rentals or are interested in growing a small portfolio of short term rental properties, Asset Based Lending can help finance your success. If you’re ready to start or grow your real estate rental portfolio using our Washington rental loans, then contact us today.

Hard Money Bridge Loans for Stabilized Proprety

With the real estate markets shifting in different directions, such as the cooling down of home sale prices and rising interest rates on rental loans, some borrower’s exit strategies need to shift with it. That’s why Asset Based Lending now offers bridge loans for stabilized properties, allowing borrowers the option to reposition their investment and wait for market conditions to match their desired exit. These bridge loans are designed for investors who have recently completed a renovation or ground up construction but believe market conditions don’t favor their current exit strategy, so they decide to hold the property as a rental. Or maybe you’re an investor that’s looking at a turnkey rental property that you may eventually sell or refinance when mortgage rates come down in the future. Either way, you need an interest only loan without pre-payment penalties to bridge the gap.

How Do These Stabilized Bridge Loans Work?

Our 2-year debt service coverage loans can help bridge your financing for up to 24 months with no prepayment penalty, so you can exit the loan whenever you’re ready. With extensions available for an additional fee, we’ll make sure you’re properly financed from start to finish so that you have time to determine your final exit strategy and capitalize on your investment at the right time. We can provide stabilized financing for properties up to 20 units, using the lesser of either market rent or leased rent to determine the DSCR and deliver you competitive loan terms. While all loans are different and structured to meet the individual investor’s needs, the typical stabilized loan is a 2-year interest-only loan with rates starting at 10.5% and LTV up to 65%-70%. Loan terms are determined based on factors such as borrower experience, FICO score, and DSCR, using the lesser of either market rent or leased rent to determine your DSCR. If you have a deal that requires temporary bridge financing, then contact us today.

Why Choose ABL?

Local Experts Who Know Your Market

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.